Enhanced ACA

Easily navigate the complexities of the Affordable Care Act with ACA compliance software

HOW YOU BENEFIT

ACA reports and compliance made simple

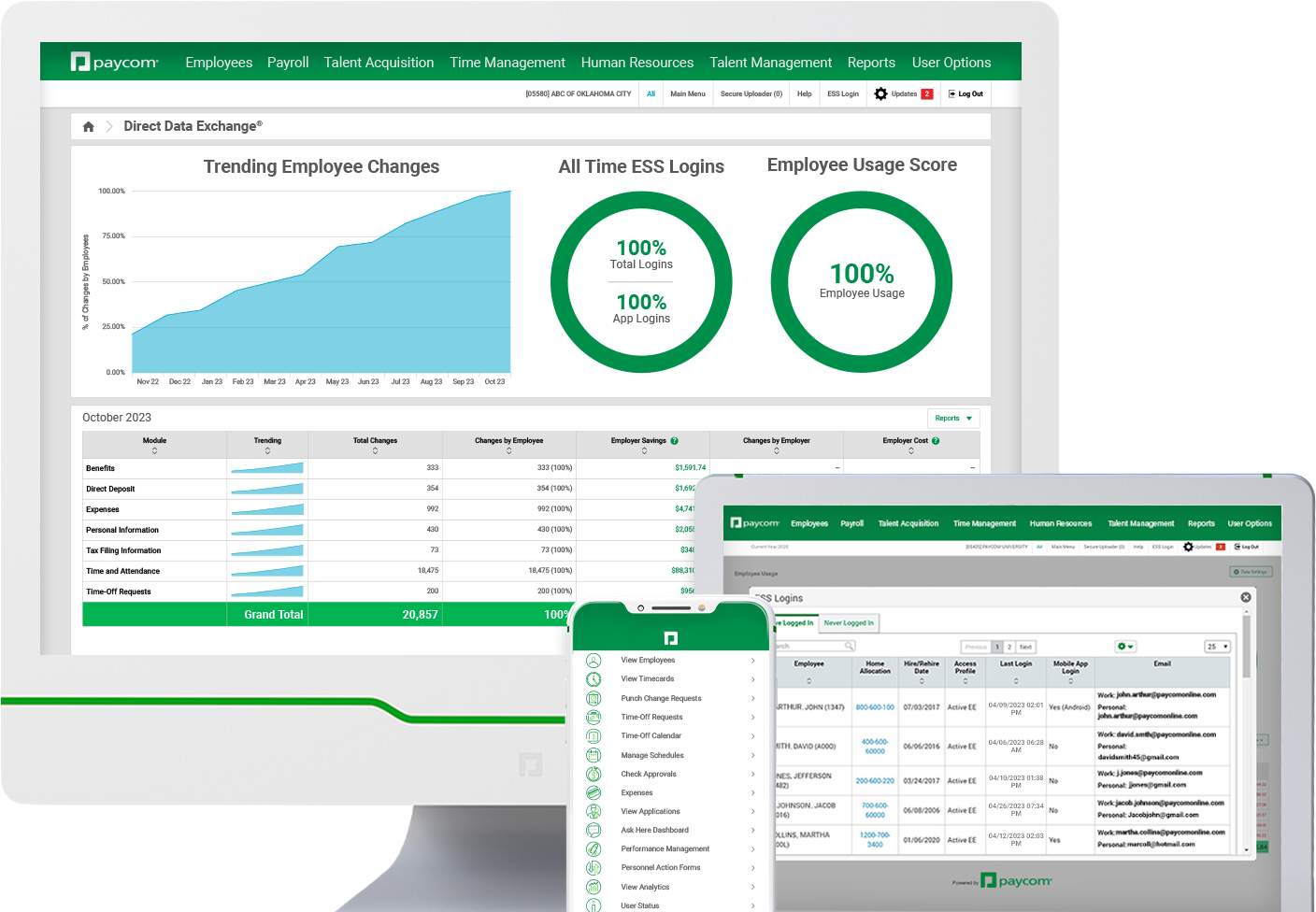

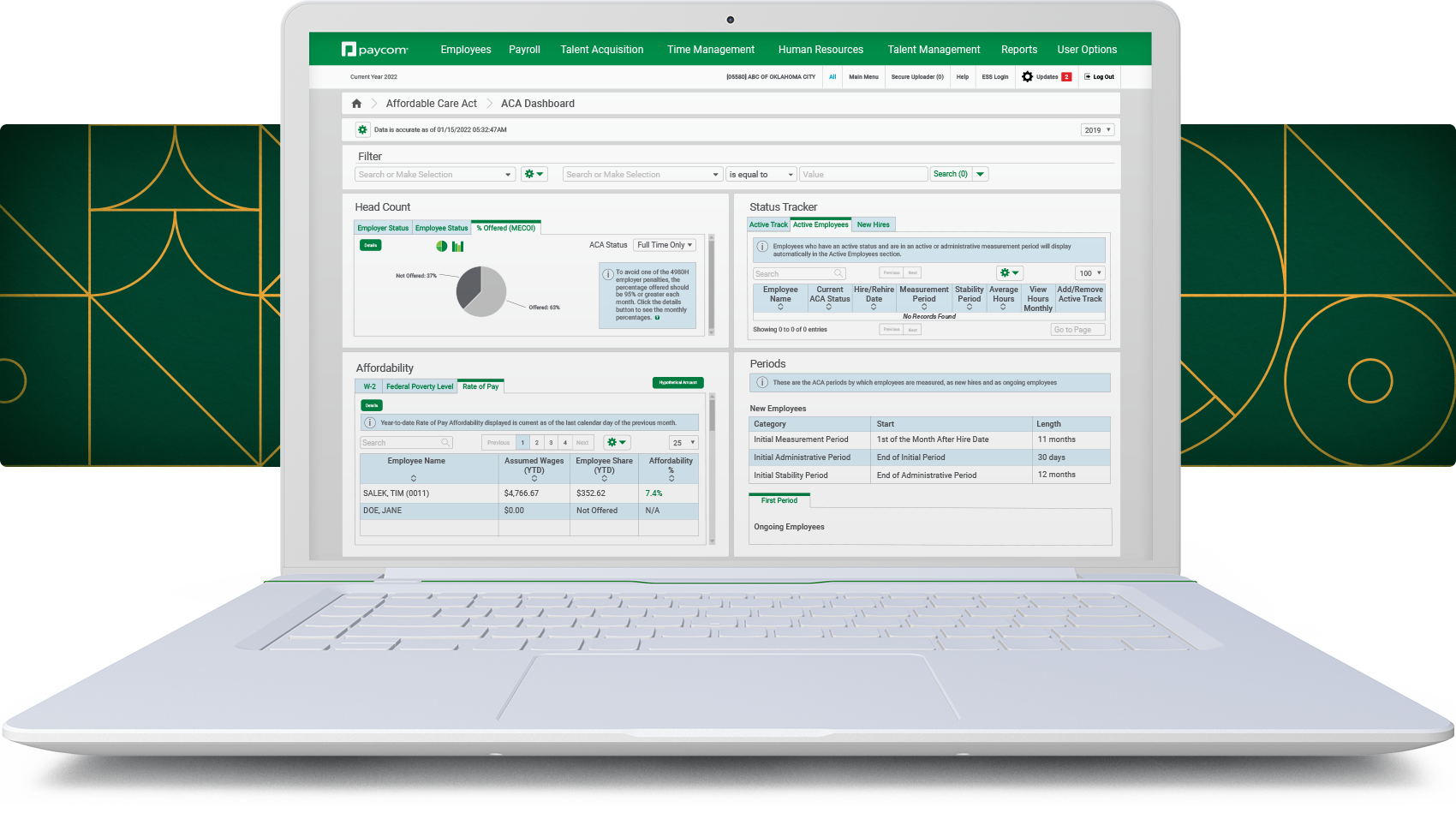

Complying with the federal government’s Affordable Care Act is a daunting, complex task, and no employer should have to face this ever-changing list of rules and regulations alone. With a real-time dashboard that displays your data in one place, Paycom’s Enhanced ACA tool is the industry’s premier ACA compliance software, designed to make the process free of pain and stress.

Using your employee data already in Paycom, Enhanced ACA files Forms 1094-B and -C or 1095-B and -C with the IRS on your behalf. An audit trail of historical data helps shield your organization against penalties. Plus, we regularly review ACA employer-shared responsibility requirements.

Proactive compliance notifications and our ACA checklist alert you when you approach applicable large employer status, when hourly workers and part-time workers near full-time status, and when employees with measurement periods near their end.

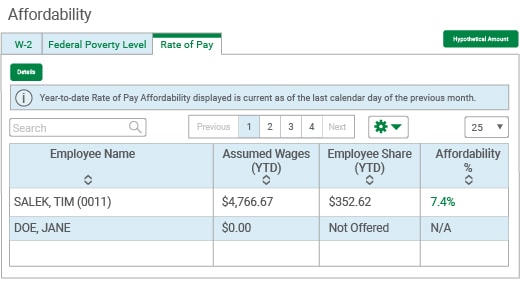

Monthly ACA reports from our Enhanced ACA software include employee ACA status changes, employee ACA trending hours, employee coverage affordability, employee coverage percent offered and applicable large employer trends.

PROACTIVE PREPARATION FOR ACA AUDITS

Nearly 34,000 companies rely on Paycom daily

“We had an ACA audit two years after implementing Paycom. We got very high praise from our auditor.”

HR director

bank

ENHANCED ACA works well with

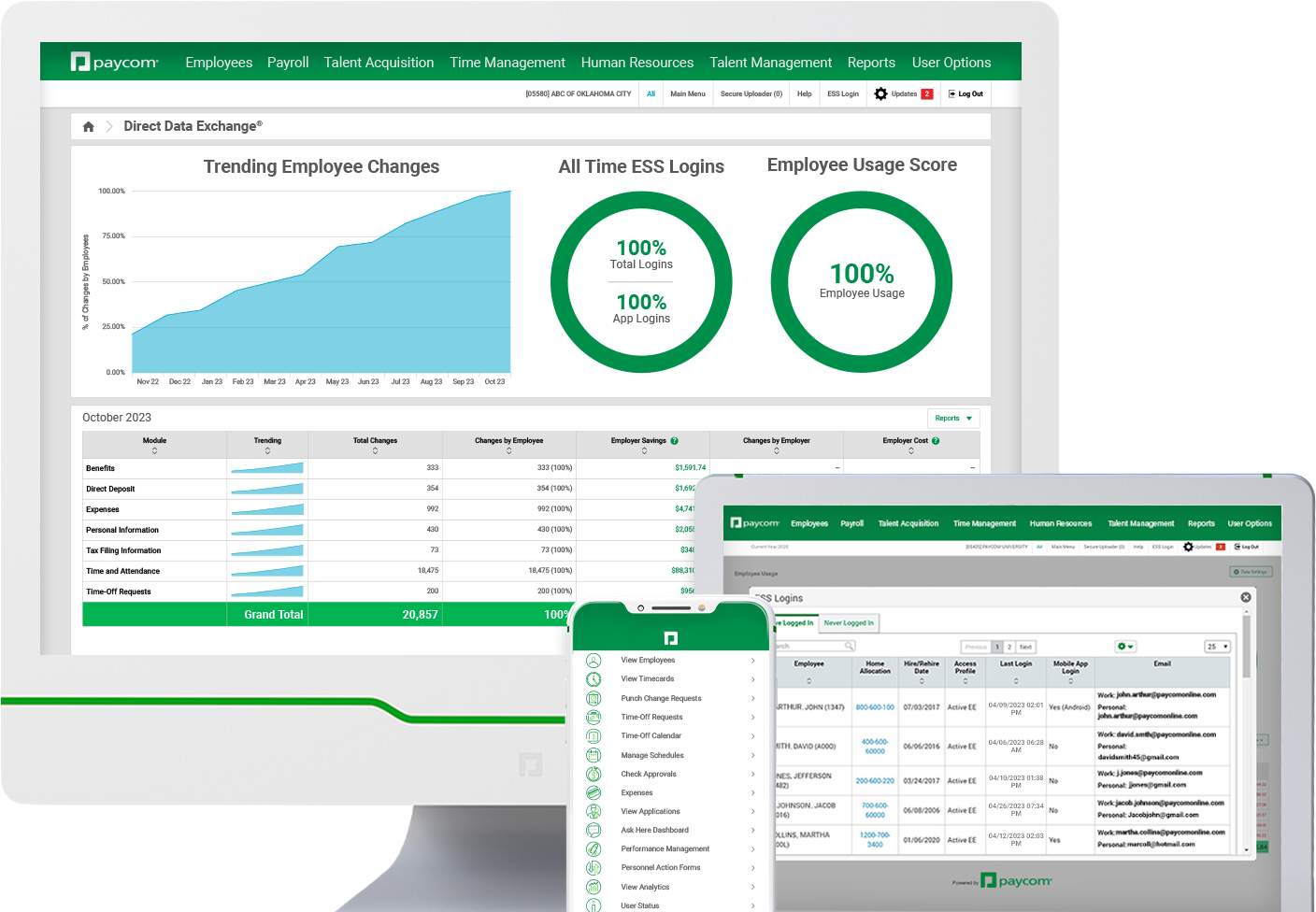

Government and Compliance

Help reduce your company’s exposure to audits and penalties surrounding employment laws.

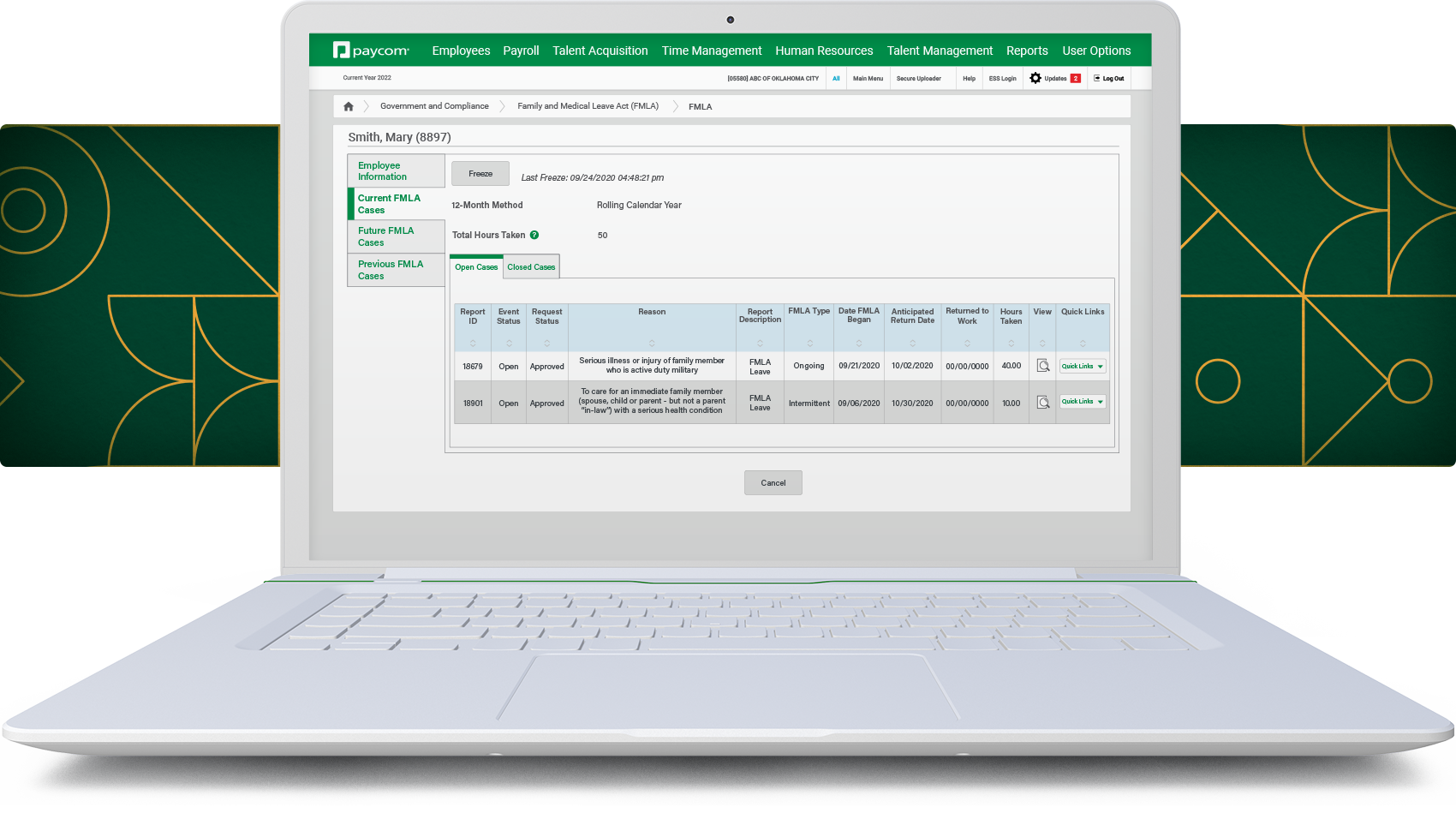

Report Center

Easily generate and review customizable or predefined reports across all workforce data in real time.

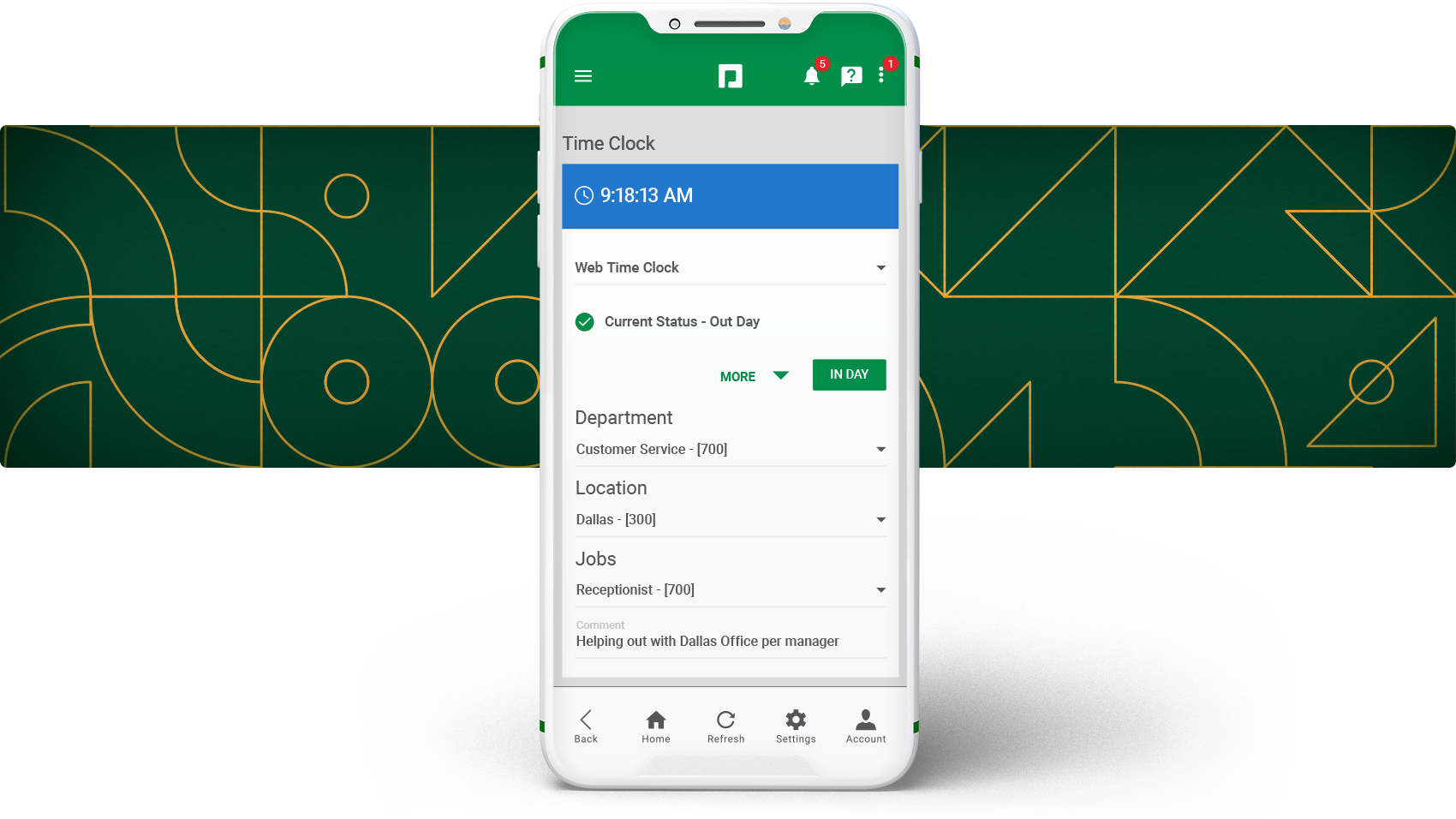

Time and Attendance

Accurately and efficiently manage when, where and how your employees report hours worked.

Explore these resources for greater ACA compliance insight

FREQUENTLY ASKED QUESTIONS

Learn what Enhanced ACA does for businesses

Yes. Under our Enhanced ACA software, this is taken care of so you don’t have to worry about it.

We mail employees’ Forms 1095-C to each client for physical distribution. However, through our Employee Self-Service® software, your employees can opt to get this form digitally as well. For employees choosing digital distribution, that year’s form remains accessible 24/7 throughout their term of employment.

Yes. Our Enhanced ACA tool keeps track of your ALE status. That calculation is based on last year’s employee hours and does not change throughout the year. Clients can see it at any time on our software’s ACA dashboard.

As part of our Enhanced ACA software, a monthly report shows the trending employee hours for the current year, while another monthly report covers employee ACA status changes. That way, clients are alerted as they approach ALE status for the following year.

Yes. A monthly report calculates affordability for offering employee coverage under each of the ACA’s three safe harbor methods. Clients can see these calculations on their ACA dashboard at any time.

No, but with any status change, Paycom clients are informed through our Enhanced ACA software’s checklist and monthly reports.

For all your HR management needs in a single software, request a meeting