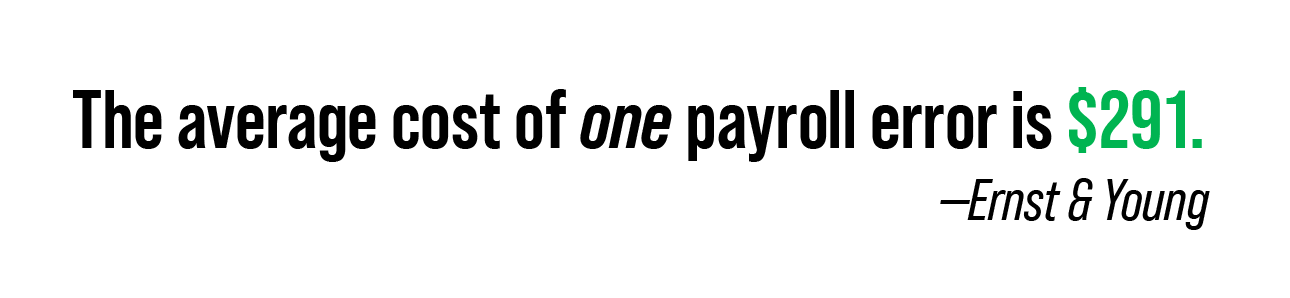

Ernst & Young (EY) recently revealed an average of 1 in 5 payrolls have errors and a typical issue costs $291 to fix. EY surveyed over 500 professionals who work in payroll at organizations with 250 to 10,000 employees.

Fixing errors is one thing. Addressing the payroll compliance issues left in their wake is another challenge entirely. Outdated processes and reactive tech add up for any business. But minor mistakes can lead to huge consequences, especially for small businesses already juggling several payroll laws and regulations.

Most organizations would reel from a large class-action suit caused by an error. For example, steelworkers in Alabama were recently awarded $13.2 million to settle a suit involving overtime miscalculations. Penalties like these don’t necessarily work on a sliding scale. In fact, a comparable payroll error at a smaller business may not just threaten the bottom line, but the company’s existence as a whole.

Though these businesses may be small, the consequences of their payroll going haywire are huge for the economy. The U.S. Small Business Administration Office of Advocacy reports small businesses make up 40.3% of private sector payroll.

Payroll laws already put pressure on small businesses to ensure they accurately calculate and prepare for:

- taxes

- potential audits

- time and labor guidance

- health care requirements

- new and updated regulations

An outdated process complicates every single one of these efforts. Ensuring payroll compliance and preventing litigation is crucial to small businesses’ success.

How does the risk of payroll litigation threaten small businesses?

Unless you’re a prominent law firm, rampant legal action is rarely good for business. A tendency to get sued by employees damages an organization’s bottom line and reputation. After all, would you work for an employer that frequently appeared as the defendant on a court’s docket for violating payroll laws?

One in six companies (14%) told EY they were involved with payroll litigation due to errors in the past year. Given 1 in 5 payrolls have mistakes, it’s not a stretch to imagine if a company leans on an erroneous process, they’ll probably get sued for it. Outdated payroll is a ticking time bomb, especially for small businesses.

How much does payroll litigation cost?

Not every lawsuit leads to a massive settlement payout. Given enough time, however, a stream of complaints takes a bite out of a small business’s bottom line and productivity.

EY discovered companies that were sued received an average of 32 legal complaints annually. Resolving these issues typically costs an average of $3,200 and 29 internal hours (about 3.5 full workdays) per year. Payroll litigation may force a company to spend time:

- consulting with legal counsel

- negotiating with the plaintiff’s attorneys

- responding to the initial complaint and discovery

- filing any other necessary pleadings

More severe payroll errors amplify this investment. EY found one company spends as much as $50,000 a year settling payroll litigation issues. This kind of expense could be devastating for a small business, and that’s not even considering how harshly it would limit recruitment.

How does payroll litigation impact employees?

While it’s hard to gauge exactly how detrimental payroll litigation is to retention, the businesses EY studied paint a bleak picture. Nearly half (44%) of them said they were forced to cut employee head count due to a lawsuit caused by an error.

If that wasn’t enough, 35% of the companies that were sued told EY they saw higher turnover because of legal action related to payroll laws and regulations. The effect of these resignations is amplified for a small business. Imagine if turnover related to payroll errors forced an up-and-coming company to:

- decline big, valuable contracts

- delay or cancel the launch of a new product

- stop offering delivery or another service

- shut down an entire storefront

And those examples are just short-term repercussions. Even if a small business is able to recuperate, it’ll face another tough pill to swallow: Gallup estimates the cost of replacing an employee ranges from one-half to two times the original worker’s annual salary.

How do payroll compliance and regulatory issues hurt small businesses?

Lawsuits aren’t the only concern payroll errors raise. More than 1 in 10 (12%) of the companies EY studied were fined by a regulatory body for misclassifying an error.

A payroll tax compliance issue could be met with an IRS penalty. On the other hand, miscalculating hours, overtime or PTO can elicit a response from a state authority. Either would be a daunting challenge for the staff (or single employee) of a small business’s HR team.

How much does payroll noncompliance cost?

Consequences rarely happen in a vacuum. The businesses EY examined learned this the hard way, with an average of 30 fines a year. Combined, this cost the companies an average of $5,200. EY’s estimate comes with an enormous caveat. The largest fine total among affected businesses was $100,000.

Payroll compliance and regulatory issues often come with additional legal costs. On average, businesses charged fines endured $4,600 a year in legal costs. One company, however, cited an additional legal tab of $96,000.

These expenses alone would be enough to severely strain a small business. But it’s not just an issue of cost, but also time.

EY calculated the average company spent 91 hours — or over two 40-hour workweeks — resolving payroll compliance issues. One business even reported a loss of 2,300 hours to address similar problems. For a single HR professional, that translates to over a year of full-time labor to address something that never should’ve happened.

Understandably, over 1 in 3 (36%) organizations informed EY they suffered a decline to their reputation from payroll compliance concerns. A damaged brand comes as no surprise given who’s impacted most by an error-ridden process.

How do payroll compliance issues affect employees?

Noncompliance represents a huge hit to any workforce, especially for a small business. More than half (56%) of companies with compliance issues told EY they had to terminate employees.

Needless to say, it’s tough to be inspired by a workplace that’s neck-deep in audits, fines and penalties. EY reported 41% of the companies with payroll compliance issues experienced a decline in employee morale. Nearly just as many (38%) of organizations saw higher turnover for the same reason.

In a Pollfish survey commissioned by Paycom, a majority (52%) of HR professionals said retention was their top priority in 2023. It’s an admirable goal, but with an outdated payroll process, HR would be hard-pressed to make it happen.

The U.S. Bureau of Labor Statistics documented over 4 million resignations between June 2021 and November 2022 — a stretch that hasn’t been recorded since 2000, when the agency began tracking this data. How many of these resignations were from small businesses on the verge of failure? And how many of them were continuing to struggle with a retroactive and outdated payroll process?

How do small businesses prevent payroll litigation and noncompliance?

It’s already too late if an organization is facing an audit or a serious lawsuit. Payroll errors have to be caught early. What businesses — especially those with under 100 employees — need is a proactive payroll process.

Beti® is Paycom’s employee-driven payroll experience. It guides a workforce to find and fix mistakes before payroll runs.

With Beti, an employee who might file a suit over a payroll issue can fix it in advance, skirting harm to themselves, their families and their employer. Plus, HR enjoys an extra layer of review courtesy of the people who know their own pay best.

Explore Paycom’s payroll tools and its single, easy-to-use app to learn how it helps your business comply, no matter its size.

Read this blog post to learn how payroll errors chip away at businesses’ bottom lines. And check out our white paper for a deep dive into how payroll errors harm businesses and their employees.

DISCLAIMER: The information provided herein does not constitute the provision of legal advice, tax advice, accounting services or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional legal, tax, accounting or other professional advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation and for your particular state(s) of operation.