Payroll Tax Management

Limit your payroll tax responsibilities and alleviate your burden with Payroll Tax Management software

HOW YOU BENEFIT

Payroll tax management without the hassle

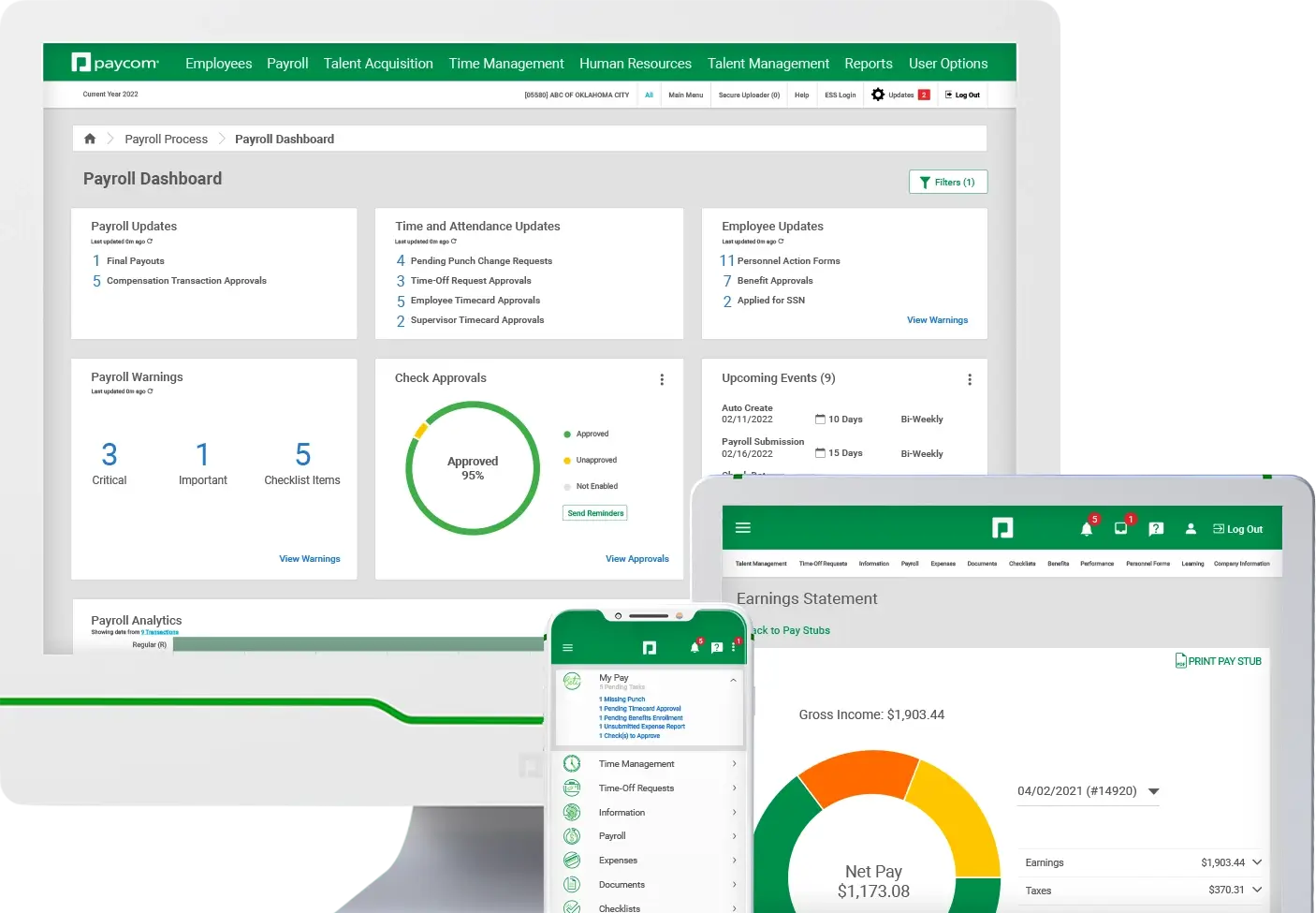

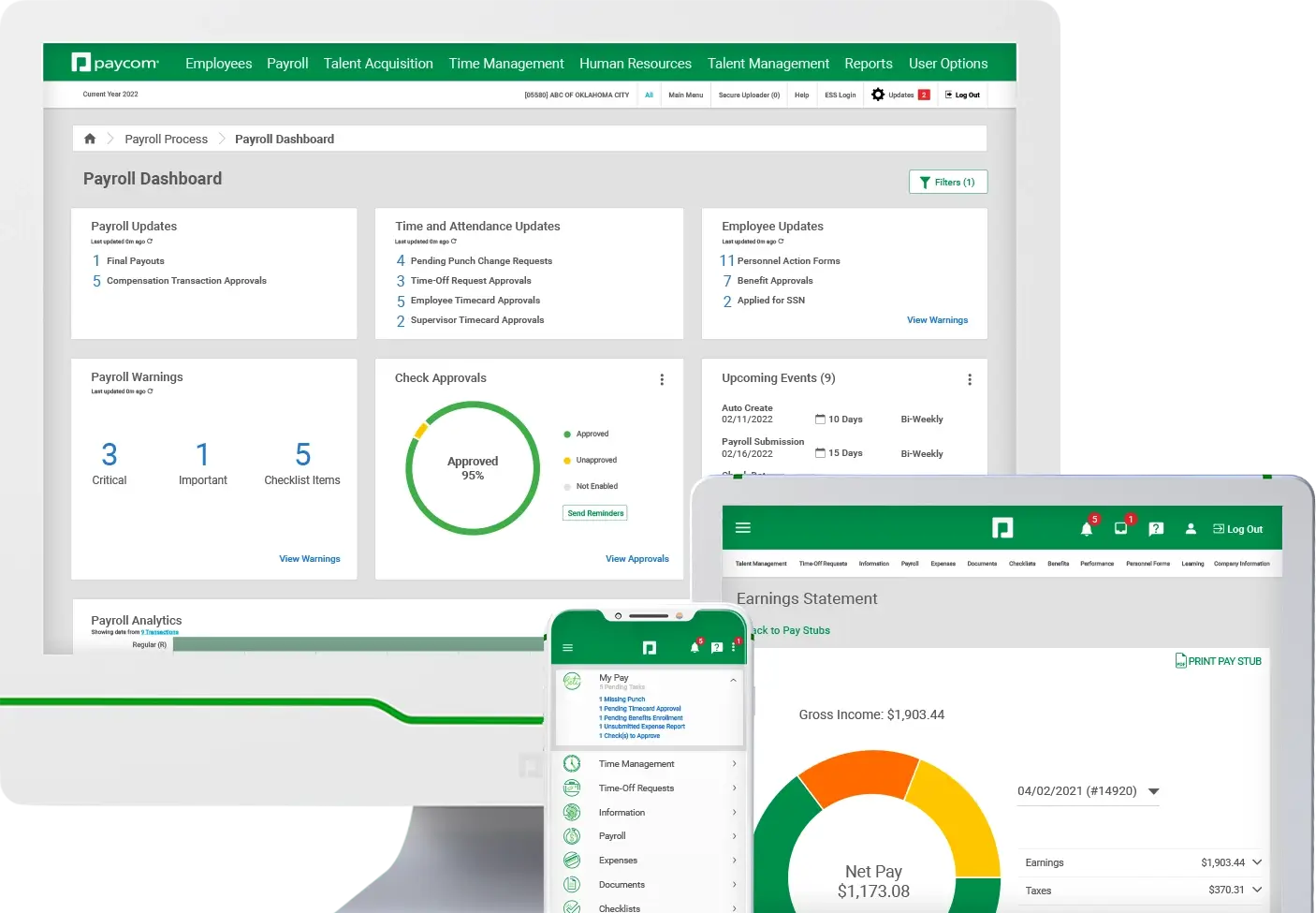

Paycom’s automated Payroll Tax Management software mitigates your organization’s responsibilities of payroll tax rates. We debit your payroll taxes, deposit them on their due dates and remit your filings — all on your behalf. Just submit your payroll, and we’ll handle the rest!

Even in the middle of a quarter, we’ll handle your IRS Forms 941. And even if Paycom doesn’t handle your payroll all year, we’ll handle your Forms 940, too! Regardless, your employees will receive only one W-2. That’s just one way our Payroll Tax Management software is a load-lifter.

We can help alleviate your payroll tax burden, no matter when you become a Paycom client. We will convert and balance all your year-to-date payroll tax totals. We’ll also remove the headache of managing tax laws in your state and local jurisdictions.

Payroll Tax Management works well with

Paycom Pay®

Eliminate the tedious, risky job of check reconciliation by issuing employee paychecks that clear off our bank account, not yours.

Explore these resources for greater payroll insight

FREQUENTLY ASKED QUESTIONS

See how Payroll Tax Management simplifies your processes

Yes, Paycom handles payroll tax reporting, filing and making any related payments on behalf of our clients.

Through Paycom, employees have the option to receive their Form W-2 digitally through our self-service app. If employees opt for a paper copy of their W-2, the form is mailed to their employer directly. Our clients are responsible for distributing paper Forms W-2 to their employees.

Yes, employees may opt in to receive digital Forms W-2 and other documents.

Through our Payroll Tax Management software, we file all payroll tax reports for our clients.

Yes, we file all Forms W-2 and related items — including Forms W-2 C — as needed by the IRS. Clients also have the option for Paycom to file Forms 1099 on their behalf.

In Paycom’s self-service app, it’s easy for employees to update this data themselves.

Paycom’s single-database software employs comprehensive, in-depth and industry-proven standards and technologies to protect and defend customer data and its privacy in our environment. As one of the few payroll processors to be ISO 27001, ISO 27701, ISO 9001, ISO 22301, SOC 1 and SOC 2-certified, Paycom’s information security and privacy management and quality management systems are formally audited and verified for compliance annually.

Absolutely. Paycom’s payroll tax management solution is designed to address the diverse tax compliance needs of businesses of all sizes. Regardless of whether you’re a fledgling startup or a well-established corporation, our platform provides robust features tailored to ensure seamless adherence to tax regulations. With customizable settings and automated processes, our software simplifies the complexities of tax administration, enabling businesses to navigate compliance requirements effortlessly. By leveraging our solution, businesses can mitigate risks associated with tax errors and penalties, thus safeguarding their financial health and reputation.

For all your payroll needs in a single software, request a meeting