Client Action Center

Easily own your tax and banking-related requests in a single dashboard for improved visibility and confidence.

HOW YOU BENEFIT

A better course of action for managing tax and banking info

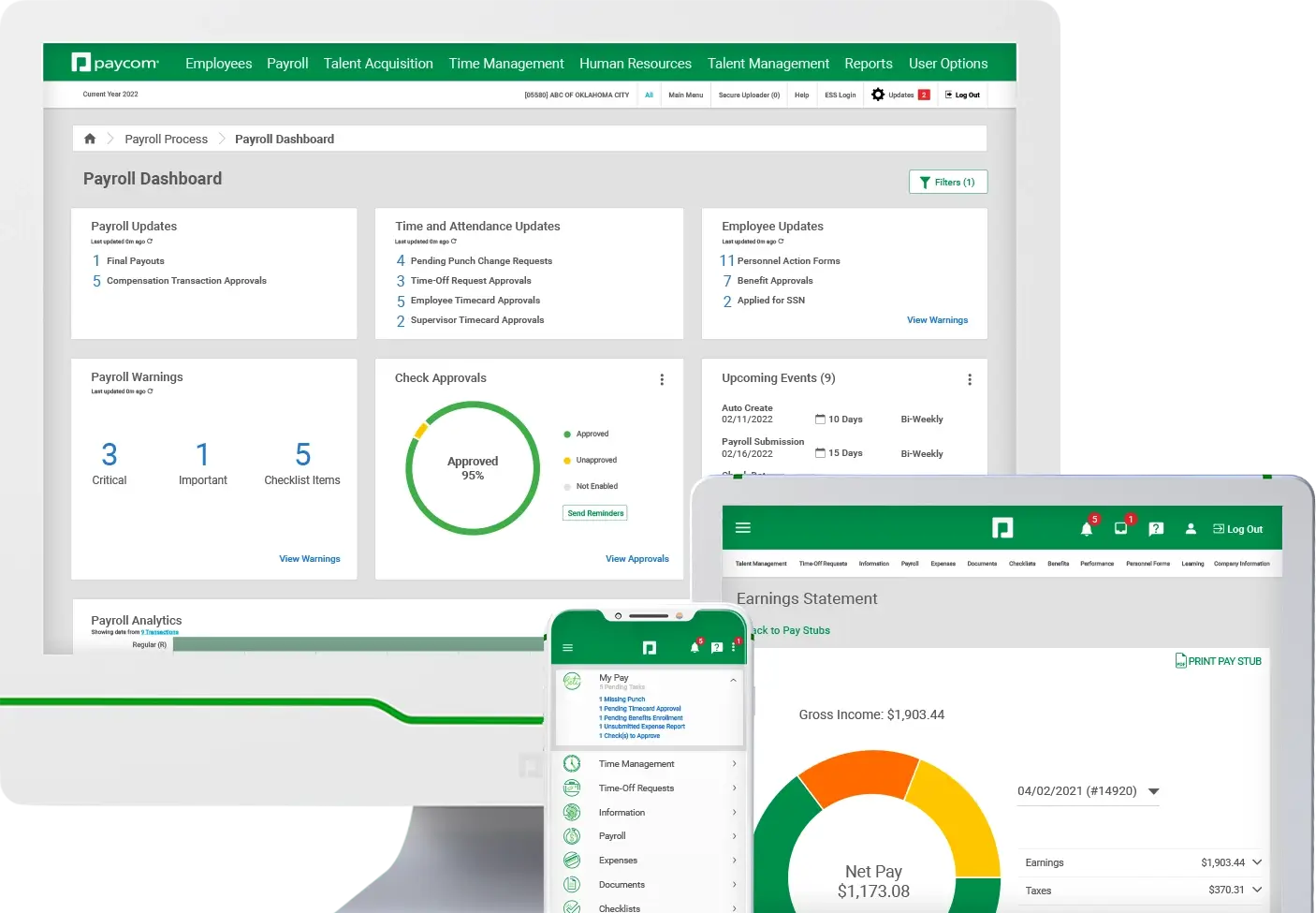

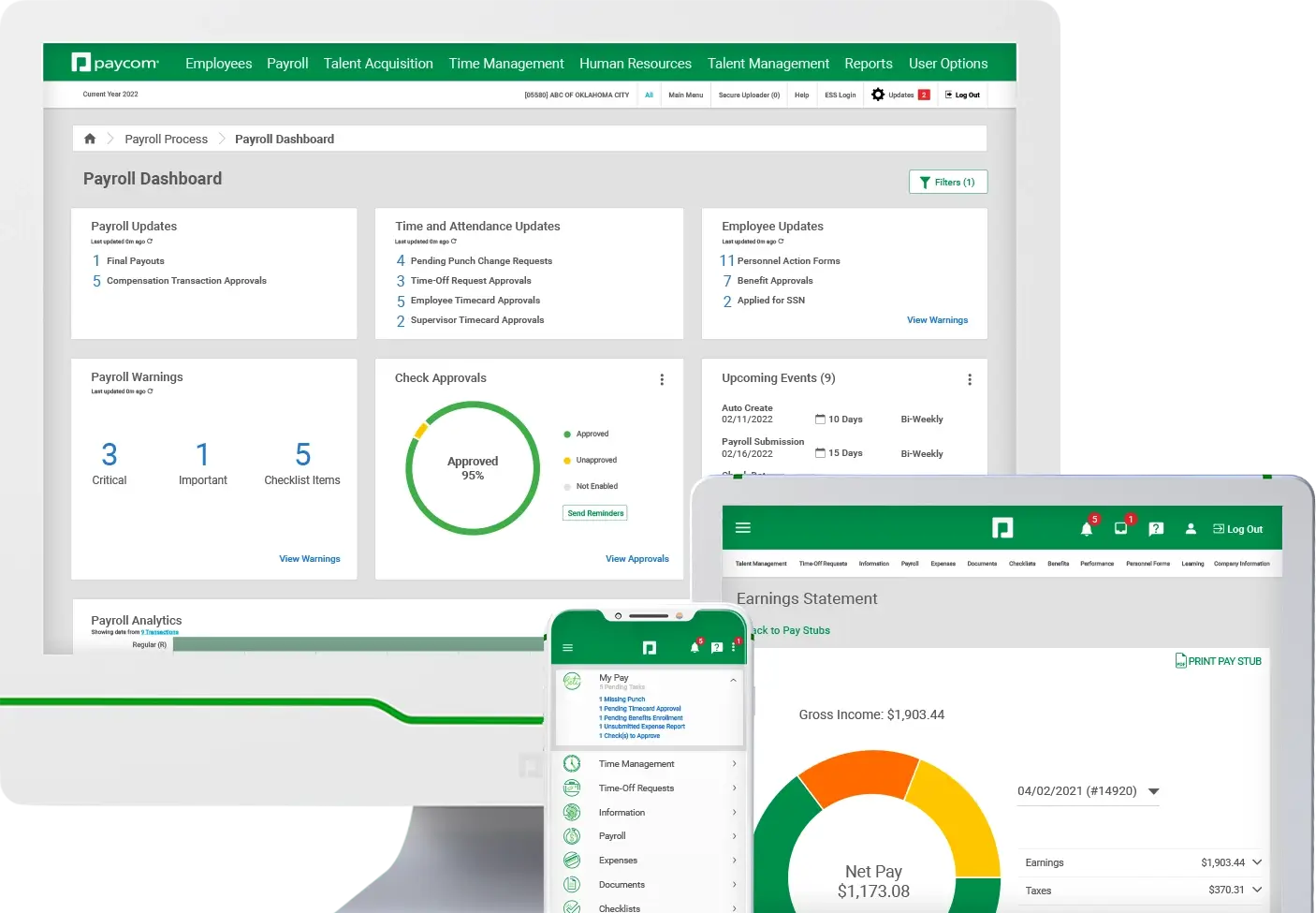

Client Action Center has the data you need to make informed, accurate decisions with real-time insights into accounts. Proactive notification and in-app communication options keep you in the loop and provide a superior user experience. Whether you're at a desk or on the go, Client Action Center is accessible in our single software.

Eliminate routine tasks with:

- electronic data sharing of tax information, bypassing the need to email or mail tax notices to Paycom

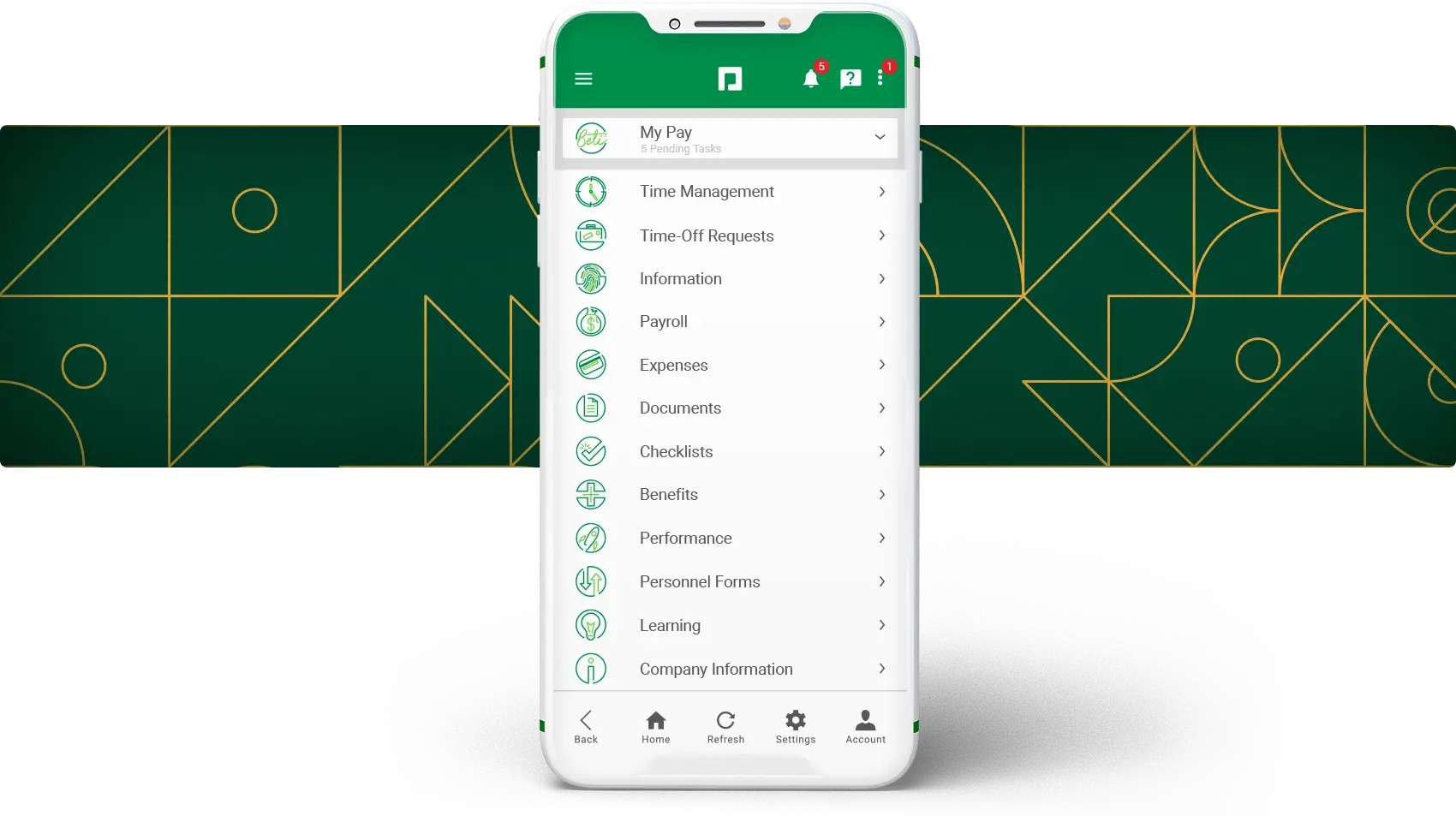

- desktop and mobile app access to tax and banking information

Gain clarity and transparency around tax issues with:

- better visibility into time-sensitive issues

- insight into each step of the resolution process

Get the information and help you need with:

- specialist contact information in the app

- a single place to view important account communication

- critical tax notifications consolidated in one location (stop searching your inbox!)

Streamline specialist communications by:

- calling a specialist directly from the app

- requesting a call from your specialist with a single click

- no hold time (because we call you!)

Easily take action with enhanced functionality

Client Action Center allows you to perform actions involving:

Client action center works well with

Payroll Tax Management

Ease the stress of payroll tax responsibilities for your organization, including conversion and balancing.

FREQUENTLY ASKED QUESTIONS

Get the specifics of what Time-Off Requests does for businesses

At this time, the Client Action Center is limited to client administrators and users with the respective permission.

Yes. By clicking the Client Action Center button in our mobile app, you have access to all tax information.

You can see pending account numbers, a complete list of tax accounts, a complete list of tax rates, power of attorney, third-party administrators and prior period adjustments.

Tax information is continuously updated. When a new account is updated by a tax specialist, it will be updated for you. The tax profile check listing on the desktop is updated and checked for discrepancies overnight.

For all your payroll needs in a single software, request a meeting