Topics covered

Takeaway

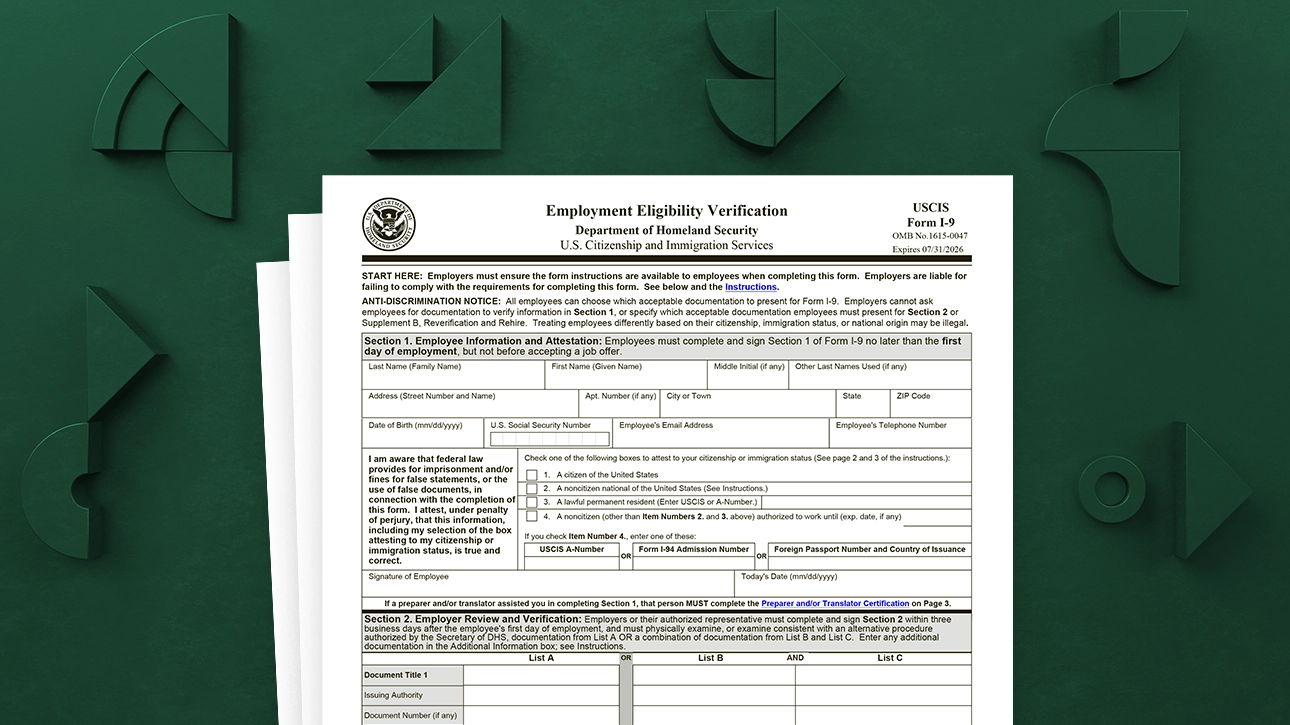

The Form I-9 is used by employers to verify work eligibility and an employee’s identity. It’s one of the most common and important documents for workplace compliance. And failing to accurately complete or update the document can leave an organization facing fines and other penalties. Read everything you need to know about how the Form I-9 works, how to complete it, common mistakes employers make and how you can simplify I-9 compliance.

Any U.S. business that hires employees must complete a Form I-9 for each of them. Although it’s a common practice that’s been in place for some time, it’s not a straightforward process.

Many employers rely on software and support services, like the Department of Homeland Security’s (DHS) E-Verify service, to simplify the process of verifying employees’ identity and employment eligibility. Even so, it’s important to understand how the Form I-9 itself works. This is especially true for the HR team that has to fix an incorrect I-9 to avoid fines and other penalties.

Luckily, completing I-9s doesn’t have to be an agonizing process. Let’s dive into:

- what the Form I-9 is and why it’s important

- what each I-9 section means and how they’ve recently changed

- 11 common I-9 errors employers need to avoid

- how a single software simplifies I-9 compliance

What is a Form I-9?

The Form I-9 is a U.S. citizenship and immigration form used to verify an employee’s identity and eligibility to work. I-9s must be completed by:

- employees

- employers or their authorized representative

Both U.S. citizens and noncitizens must complete the form. Employers, on the other hand, must determine that the documents provided by their employee during the I-9 process are genuine and accurately represent the person in question. Employers must also retain their completed Form I-9s for federal audits and inspections.

Why is the Form I-9 important?

The Form I-9 helps employers verify their staff’s status and eligibility to work in the U.S. I-9s also help employees ensure their legal information is correct and updated.

If employers fail to maintain I-9s for every worker, they risk:

- audits

- hefty fines

- legal penalties

An incomplete or inaccurate Form I-9 may not automatically result in any of these consequences — provided HR quickly corrects the botched filings. For this reason, the Society for Human Resource Management suggests employers periodically review and correct I-9s in case of a governmental audit.

Who needs to complete the Form I-9?

Employers must complete a Form I-9 for every person they hire, including both citizens and noncitizens. Additionally, every Form I-9 requires the employee it covers to attest to their authorization to work. This includes a production of evidence, like a state-administered license or work permit. Employers must then examine these documents for credibility and a connection to the employee before recording it on a Form I-9.

What is a Form I-9 used for?

The purpose of a Form I-9 is to confirm an employee’s identity and eligibility for employment in the U.S. The U.S. Citizenship and Immigration Services administers this form, and the Department of Labor typically inspects it. Employers are expected to retain this document so it can be produced if requested by the federal government. Largely, the Form I-9 is used to help prevent fraud and the employment of unauthorized workers.

What are the sections of the Form I-9?

Companies need to ensure new hires quickly and accurately complete I-9s. But helping them do it is easier said than done without an understanding of what each of the form’s three sections does. Consider the following explanations your crash course.

Section 1

Naturally, the Form I-9’s initial section requires the most urgency. It needs to be completed no later than an employee’s first day. Keep in mind, it’s possible to complete this section before an employee formally starts with the right self-onboarding software.

New hires should also provide their employer with proof of their identity and work authorization within three days of their start date.

| Examples of Acceptable Form I-9 Documents | ||

| List A | List B | List C |

| U.S. passport | Driver’s License | Certification of birth abroad |

| Permanent resident card (Form I-1551) | Military ID | Native American tribal document |

| Foreign passport with a temporary I-551 stamp | Voter registration card | An employment authorization issued by DHS |

| Social Security card | ||

Employees are required to provide either:

- a document from List A

- a document from List B and List C

- in certain cases, you may also present a valid and acceptable receipt of the documents in List A, B, or C

If an employee’s confused about any of these documents, consider providing examples of each to help them identify what they have. Remember, an employer can’t require that employees only submit certain documents, like a passport.

Section 2

Within three days of when employment begins and after employees provide acceptable documentation, an employer or its authorized representative must verify the material’s authenticity. Generally, this review takes place in the relevant employee’s presence.

If you use E-Verify, you may have the option to remotely examine employees’ documents under an alternative procedure authorized by DHS. Contact the agency or a licensed professional to make sure.

Supplement A

This section is for interpreters, translators and preparers who assist an employee in completing their portion of the I-9. The individuals must provide their name and address as well as complete a separate certification section on Supplement A. These supplemental forms must also be retained with the completed I-9.

Supplement B (formerly Section 3)

This section is only applicable if an employee:

- has an expired work authorization

- legally changed their name

- was rehired

How to fill out a Form I-9: step-by-step instructions

Though businesses regularly interact with the Form I-9, this document tends to carry the most mistakes. Consider how each of its pieces should be completed before making an assumption.

1. Section 1: Employee information and attestation

Employees — not their employer — should complete this section of the Form I-9. It requires an employee to provide their:

- full name

- address

- data of birth

- Social Security number (SSN) if applicable

- email address

- phone number

Beyond the general information, an employee must attest that they are legally authorized to work in the U.S. by signing and dating the form. An employee who is a noncitizen but authorized to work must also include an alien registration number (aka “A-number”) or a Form I-94 admission number.

2. Section 2: Employer review and verification

This section of the Form I-9 is completed by employers to verify employment eligibility. It should be completed within three days of the applicable employee’s start date.

If an employee provides a document from List A, that’s it — an employer only needs to attest to the legitimacy of that document. If an employee doesn’t have a document from List A available, they must provide a valid, unexpired document from Lists B and C for review.

After confirming employment eligibility, an employer must record:

- the employee’s official start date

- the organization’s name

- a business address

- the job title of the employee executing the document on behalf of the employer

Employers also have the option to remotely examine a Form I-9 if they’ve enrolled in E-Verify through DHS.

3. Supplement A: Preparer and/or translator certification for Section 1

If an employee needed assistance completing Section 1, the individual who helped them must include their name, address and signature on Supplement A.

4. Supplement B: Reverification and rehire

Supplement B is needed when an employer:

- rehires a former employee

- reverifies an employee whose work authorization has expired

- reverifies an employee who legal name has changed

If the returning employee is hired within three years of the data on their original Form I-9, an employer can complete this supplement or produce a new I-9.

The section only requires the employee’s current name and their rehire date. If the employee’s prior work authorization expired but has been extended, employers must also provide info about that document and the new expiration date. Like the previous sections, an employer must also execute this document to confirm their belief that the employment documents they reviewed are genuine and their employee can legally work in the U.S.

How do I reverify a Form I-9?

For certain employees with temporary work authorizations, it may be necessary to reverify their Form I-9. Employers may also need to update an I-9 when an employee legally changes their name.

Should you be required to reverify an employee’s work authorization documentation, take the following steps:

- Ensure the affected employee provides acceptable documentation, similar to when you may have first hired them.

- Complete Supplement B of the I-9, which captures the date when an employment authorization document expires.

- Retain a copy of your I-9 and confirm any future deadline for reverification.

What are the most recent updates to the Form I-9?

Released on Aug. 1, 2023 by U.S. Citizenship and Immigration Services (USCIS), the latest Form I-9:

- reverts to the pre-pandemic policy of reviewing employee documentation in person (if E-Verify isn’t used)

- adds a checkbox in Section 2 to confirm remote document examination

- reduces the Form I-9 instructions’ length from 15 to eight pages

How do employers comply with the Form I-9?

Every U.S. employer must complete I-9s for their employees — no exceptions. As of 2025, those that don’t could face penalties of:

- $288 to $2,861 for I-9 paperwork violations

- $716 to $5,724 for recruiting, referring and hiring for each knowingly employed unauthorized worker

- $5,524 to $14,308 for second hiring offenses

- $8,586 to $28,619 per third and subsequent hiring offenses

- $973 to $1,942 for employers using E-Verify who fail to inform DHS of continuing employment following a notice of Final Nonconfirmation

Even in the absence of fines, failing to comply with Form I-9 requirements amplifies the workload for HR. Incorrect or incomplete I-9s force them to sink hours into:

- identifying specific issues

- gathering the proper documents from employees

- verifying the new material is correct

This consumes time HR could instead invest in more important initiatives like employee well-being and engagement. Conducting regular, internal I-9 audits helps employers proactively address errors, missing information and other compliance needs.

What are the most common Form I-9 errors?

Not every I-9 error implies an employee isn’t eligible to work. An error could indicate their form or supporting documents contained mistakes. Here are 11 of the most common I-9 blunders.

1. Spelling mistakes

Even a small typo on someone’s name or address could lead to an incorrect I-9. Relying on software or just reviewing a new hire’s Form I-9 before filing can be enough to prevent a compliance headache.

2. The wrong combination of acceptable documents

Something as simple as providing two items from List B when an employee needed documents from List B and List C can create a violation. Employers should understand which documents fall under which list and help new hires identify what’s most appropriate.

3. Too many acceptable I-9 documents

Too much material — like proof of an employee’s citizenship that they attest to in Section 1 — can be considered discriminatory, according to the Department of Justice. Simple and minimal is ideal when it comes to acceptable I-9 documents.

4. Late physical inspection of virtually verified I-9 documents

The option to virtually inspect I-9 documents during a hiring spree proved useful, but employers shouldn’t forget this was meant as temporary relief. If a company didn’t physically inspect affected employees’ I-9 materials by Aug. 30, 2023, they may be out of compliance.

5. Missed three-day deadline

Employees have three days from their formal start date to produce acceptable documents and complete their Form I-9. If they miss this window, the affected employee is technically not authorized to work and could be terminated. Complete this step early — before a recent hire is in the thick of their new responsibilities.

6. Incorrect birth dates

It’s an easy mistake we’ve all made. In school, most of our assignments asked for the current date at the top of the first page. The Form I-9, however, doesn’t request it until the end of Section 1. Employers should be mindful of this distinction and vet every I-9 field before filing.

7. Missing dates or signatures

After a while, every field of a form can start to look the same. Unfortunately, omission is a straight shot to non-compliance. Supplement B might not be required, but everything before it should be completed.

8. Corrections submitted without a date or initials

Like signing the initial Form, employees and employers must date and initial corrections to Section 1 and Section 2, respectively. USCIS requires this confirmation, even if the fix clearly resolves the original issue.

9. Unverified information or documents

It seems obvious, but it’s not enough for employers to verbally verify a Form I-9 and its acceptable documents. They need to acknowledge it on the form itself through the appropriate checkbox. This minor mistake can unwind hours of completing and confirming a filing.

10. Not supervising or guiding employees through Section 1

If the I-9 process isn’t automated, employers’ best shot at ensuring accuracy is to directly supervise people and guide them through Section 1. It might be time-consuming, but not nearly as much as resolving an erroneous filing.

11. Lack of training

Employers and employees alike need to understand the purpose of the Form I-9 and how to complete it. Businesses should regularly train HR on how to identify acceptable documents and other common I-9 issues. Avoid referring employees to USCIS for basic questions. Even a brief explanation and short, semi-regular trainings go a long way to prevent noncompliant I-9s.

12. Choosing the wrong issuing agency for Social Security cards

It’s not enough for an employee to provide a Social Security card. Employers also need to accurately identify the correct issuing agency, which will be either DHS or the Social Security Administration. While the Social Security Administration issues many cards, those for permanent residents and temporary workers may feature an endorsement from DHS. It’s crucial employers recognize this endorsement before finalizing their I-9 Forms.

E-Verify vs. Form I-9

The Form I-9 is what the government tool, E-Verify, uses to confirm employment eligibility. E-Verify compares data from a Form I-9 with records from the Social Security Administration and DHS.

While the use of E-Verify may be voluntary for most employers, completing a Form I-9 is mandatory. Additionally, a Form I-9 doesn’t require an employee’s SSN, but E-Verify does in order to cross-examine Social Security records. Additionally, E-Verify requires photos or identification documents and, unlike a Form I-9, cannot be used to reverify expired employment authorizations.

What is the penalty for Form I-9 noncompliance?

DHS administers fines and other penalties for failing to accurately complete or provide a Form I-9. Unlike violations for other documents with preset fines, however, the exact punishment for noncompliance is determined by DHS on a case-by-case basis.

Fines

DHS imposes civil penalties, or fines, on an organization if it knowingly employed someone who was not authorized to work in the U.S. or for continuing to employ unauthorized workers. DHS will issue a notice of its intent to impose penalties, and an employer may request a hearing to respond within 30 days of their receipt.

DHS or an appointed judge may also administer fines for failing to complete or properly retain a Form I-9. These penalties vary depending on:

- the organization’s size

- if it acted in good faith

- the severity of the violation

- the company’s history of I-9 violations

- whether the employee covered by the I-9 is legally authorized to work in the U.S.

Legal consequences

Employers who show a pattern of employing unauthorized workers or repeated I-9 violations may be subject to criminal penalties, including six months of imprisonment. Managers and executive leadership that engage in fraud on behalf of their organizations — such as by falsifying employment documents, identity theft or a false attestation — may be fined and face up to five years of imprisonment.

How does Paycom help with the Form I-9?

Paycom overcomes the biggest challenges of I-9 compliance by automating employment identification and verification within its single software. Paired with our E-Verify® tool, new hires only enter their information once for it to flow seamlessly throughout Paycom.

You can safely and securely store completed I-9s in Paycom alongside your workforce’s other important documents. Plus, our E-Verify tool automatically prepopulates employee information when creating new cases. You’ll even receive a notification of documents expiring soon so you can:

- easily complete the rehire and reverification supplement

- verify I-9s ahead of their deadlines

- build self-audits into your I-9 process for greater peace of mind

Plus, Paycom’s easy-to-use dashboard helps you immediately identify pending or incomplete I-9s and other action items.

Form I-9: FAQ

Is a Form I-9 a background check?

No, a Form I-9 is not a background check. While it does help verify an employee’s identify and eligibility to work in the U.S., it doesn’t include a search of the employee’s criminal history, their education or other searches typically conducted during a background check.

What happens if an employee does not complete a Form I-9?

If an employee — and by extension their employer — fails to complete a Form I-9, the employer could face civil penalties like fines from DHS. An employer may decide to terminate an employee who refuses to provide a Form I-9 to avoid noncompliance.

Who is exempt from completing an I-9?

Generally, employers must complete an I-9 for every employee they hire, but some exceptions include:

- individuals hired on or before Nov. 6, 1986, when I-9 verification became law

- those hired for casual, sporadic or inconsistent domestic work at a private home

- independent contractors

- employees not physically working in the U.S.

Does a 1099 employee need to fill out a Form I-9?

No, independent contractors — or 1099 employees — do not need to complete a Form I-9.

Why is my employer asking for an I-9 again?

An individual employee may be required to complete a new Form I-9 if their previous work authorization has expired. If an entire organization is asked to complete a new Form I-9, it could be for a larger, compliance-related purpose. For example, an employer may receive a government contract that’s contingent on its employees having updated Form I-9.

What triggers an I-9 audit?

An I-9 audit can be initiated by numerous factors, but most will be spurred by:

- complaints from current and former employees

- a flag raised about the business by immigration authorities

- an employer operating in an industry where I-9 violations are common

When should a Form I-9 be completed?

An employee should complete Section 1 of the I-9 no later than their first day of work. Employers, on the other hand, have three days from within the applicable employee’s start date to complete the document.

Can a Form I-9 be completed electronically?

Yes, the Form I-9 may be signed and verified electronically.

Do remote employees need to complete a Form I-9?

Yes, if they are performing any work in the U.S.

How many sections are on the Form I-9?

The Form I-9 is composed of two sections and two supplements. They are:

- Section 1: Employee information and attestation

- Section 2: Employer review and verification

- Supplement A: Preparer and/or translator certification for Section 1

- Supplement B: Reverification and rehire

Are the Forms I-9 and W-9 the same?

No. The W-9 is for independent contractors and relates to tax reporting, not employment eligibility.

Can employers verify employee supporting I-9 documents remotely?

Yes, provided they enrolled in E-Verify.

Can employers tell employees which acceptable documents to present?

No, an employee may provide any of the acceptable documents from Lists A, B or C. Their employer may not refuse an employee’s submission if it is one of the documents provided from that list, though the employer will still need to attest to the document’s legitimacy.