HR and payroll software for nonprofits

Engage your people and amplify your mission with an automated, single HCM software

Why Paycom

Because we support your mission

Your nonprofit is here to serve. But managing the business side of things can be a challenge. How do you hire and retain talent while navigating a tight budget and complex compliance requirements?

It’s easier than you think. Paycom’s single HR and payroll software is designed to help you streamline your processes, elevate employee engagement and focus on what matters most: your mission.

Award-winning HR and payroll innovation

names Paycom best app for employee-driven payroll

How we help

Helping you serve the greater good

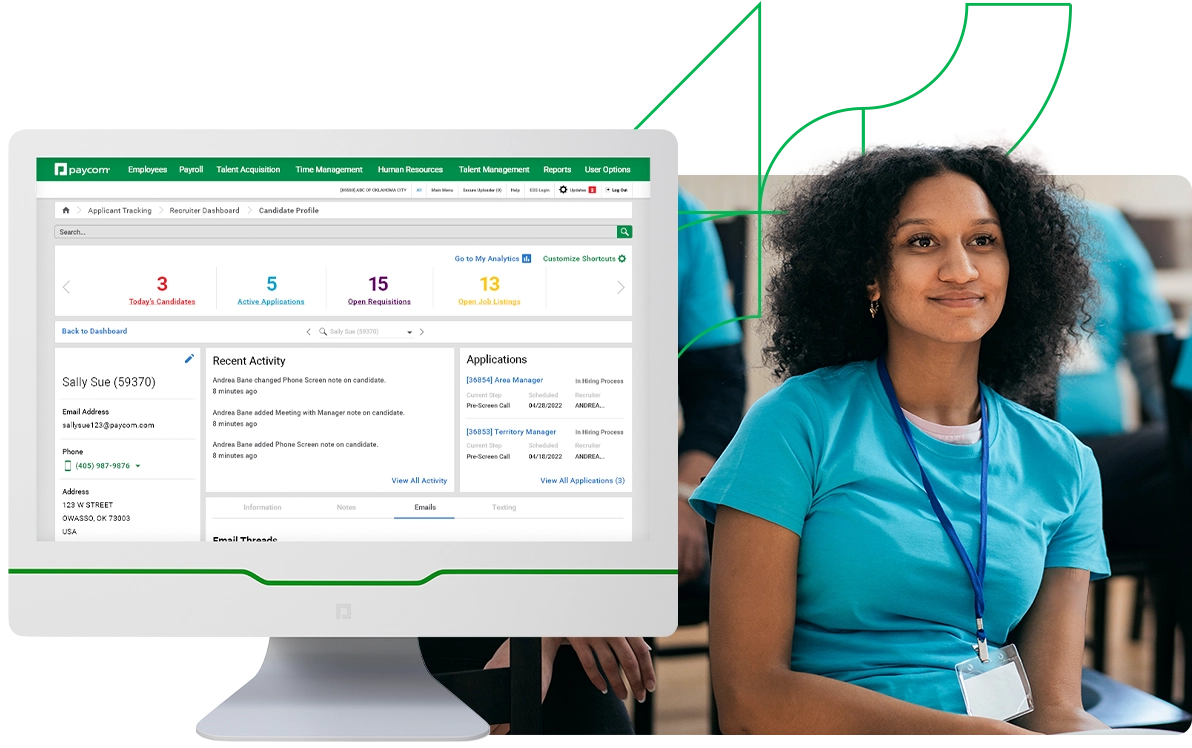

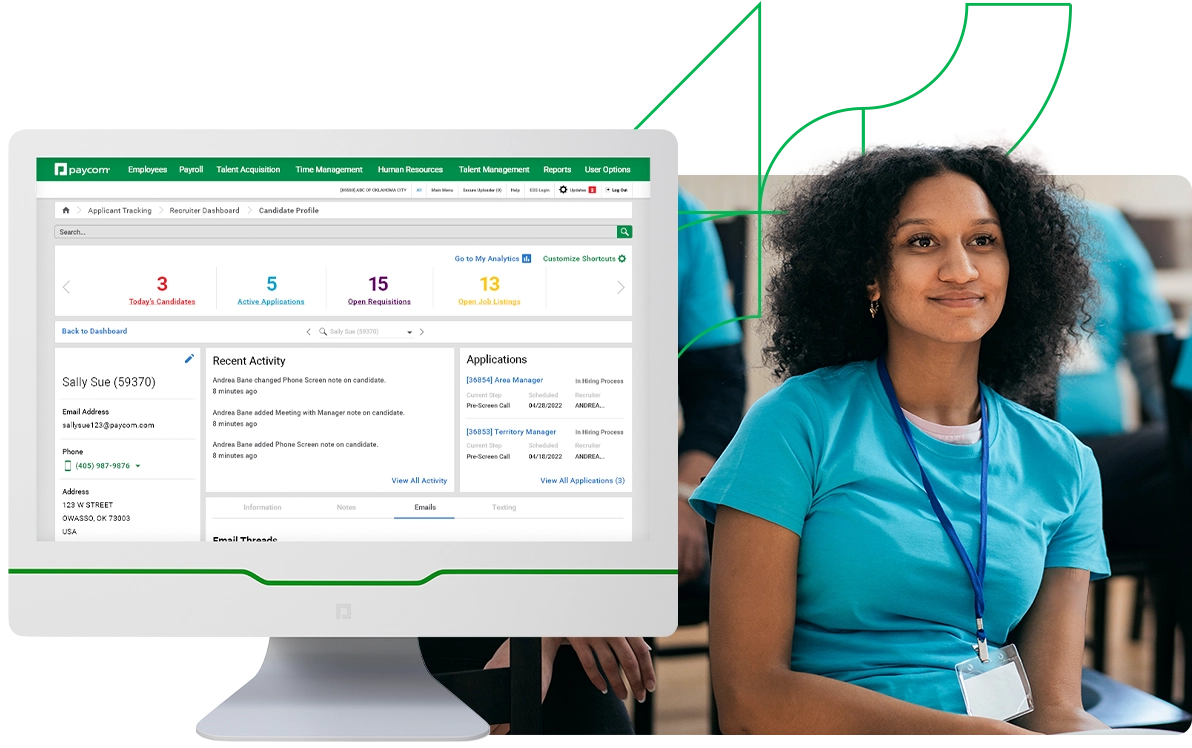

With wage competition and changing employee expectations, it’s harder than ever to attract and retain top talent. But Paycom makes it easy to create an engaging employee experience that sets your nonprofit apart. It empowers your people to manage their own HR and payroll data in a single, easy-to-use app. They can complete and sign documents, onboard, take trainings, ensure paycheck accuracy, make their voices heard and a whole lot more.

Fast, thorough screening

When you’re committed to helping those in need, you must be certain that a candidate is the right fit. Our background checks service allows you to quickly and thoroughly vet candidates to ensure they don’t pose a threat to your nonprofit or its mission.

Efficient onboarding

Finding quality employees shouldn’t take time away from your cause. Paycom has all the tools you need to fill open positions. Along with a streamlined hiring process, self-onboarding allows employees to complete new-hire documents and trainings before Day 1 so they can make a difference immediately.

Error-free payroll

Even one payroll error can cause people to leave. Why not empower them to ensure their pay is right? Our self-service payroll experience automates the process. It identifies errors, then guides employees to fix them before submission, so you don’t lose valuable team members to a preventable issue.

Comprehensive, intuitive training

Employees join nonprofits to make an impact. Paycom helps ensure it’s a positive one. Our flexible and easy-to-use learning management system lets you create custom trainings they can complete anytime, anywhere. They get the skills and knowledge to effectively serve and you get the compliance peace of mind you deserve.

Raise the bar

Maximize your mission

Continuing to make an impact means making the most of the resources you have. Paycom helps you make every dollar count, so you can do more for the people you serve.

Tech that proves its worth

Your nonprofit can’t afford tech that doesn’t boost your bottom line. Paycom measures your employees’ usage of our software and reveals opportunities to help you further maximize your ROI and engagement.

Audit-ready reporting and analytics

Audit penalties can eat up your already limited resources. With Paycom, you’re always ready to meet any regulations or funding requirements. Our advanced reporting software lets you create custom reports in the formats you need. We’ll even create and automatically send recurring reports to those who need them.

Keep tabs where it counts

Resources can often be tight. Without a clear way to effectively budget for staff, nonprofits can’t grow or even maintain their teams, let alone accomplish their goals. With Paycom, you can easily track where your labor dollars are spent to make sure your money and their work count.

See what nonprofits are saying about Paycom

Frequently Asked Questions

Learn more about HR technology for nonprofits

HR and payroll software for nonprofits helps organizations automate essential processes like finding and keeping the right talent, ensuring their payroll is accurate, and maintaining compliance and reporting for a variety of regulations and restrictions.

The right HR and payroll software helps streamline processes and frees nonprofit staff from the administrative burden of managing manual tasks so they can focus on more meaningful initiatives. Plus, Paycom’s truly single software puts all the tools HR and payroll pros need to keep their nonprofits running all in one place — no data reentry or switching between platforms required.

Beti®, Paycom’s automated payroll experience, self-starts at the beginning of each pay period and updates with live data until you hit submit. This means your nonprofit can go from constantly managing payroll to simply monitoring it. Employees can also view their checks before payday, and Beti guides them to fix any errors before payroll submission.

Whether for funding, grant management or even workforce budgeting, Paycom’s robust reporting tools help ensure you’ve got everything you need to help stay compliant and audit-ready. Choose from one of our predefined reports or create custom reports, easily filtering the exact specs you need in the format you need them. Plus, set up Paycom to automatically send recurring reports when you need them — whether daily, weekly, monthly, quarterly or annually.

Paycom’s automated payroll experience empowers employees to review their paychecks for 100% payday accuracy. In fact, it automatically flags errors, then guides employees to fix those errors before payroll submission. When even one payroll error could give an employee a reason to leave, a perfect paycheck is priceless.

With Paycom Learning, you can create training courses and paths that fit your nonprofit’s unique needs, goals and compliance requirements. Ensure your workforce fully understands policies and procedures and has the operational training it needs to make a difference. Or choose from our course library, including lessons on leadership for managers and employees as well as soft skills and more.

Once you hire the right talent for your nonprofit, Paycom’s Onboarding tool allows employees to complete any new hire documents or training even before Day 1, so they can start contributing to meaningful work right away.