How would you react to an unexpected bill for $1,400?

According to the financial services company LendingClub, that amount represents the average cost of an emergency expense endured by American households. However, with nearly two-thirds of Americans living paycheck to paycheck, withstanding such an emergency expense can be a real, well, emergency — with no easy solution. To make matters worse, Statista research shows the average American employee earns $10.95 per hour, down from $11.23 a year before. The nation’s poverty rate has grown to 11.4% after five straight years on the decline.

With these realities in mind, the risks associated with payroll errors simply can’t be overstated.

Avalanches always start small

The consequences of a simple payroll error on an individual’s paycheck can touch all parts of a household, with enormous downstream consequences for even seemingly minor interruptions.

Let’s consider just a few of the ways a missed or incorrect paycheck can result in truly negative outcomes for affected employees.

1. Unexpected medical expenses

LendingClub found 21% of consumers will face at least one health-related emergency within the next 90 days, at an average cost of $1,361.

That surprise would be unpleasant enough on its own, but coupled with Gallup estimating almost 18 million Americans can’t afford their currently prescribed medications, the ramifications begin piling up. What happens when someone has to choose which vital medication to take and which one to decline?

When the potential expense of medical attention causes patients to delay or even avoid treatment, further health complications commonly result. Something as simple as a seasonal flu or minor injury, when left untreated, could develop into a chronic condition that makes it hard to work, care for family or just manage a normal existence.

2. The rising cost of child care

Child care expenses already pose a strain, consuming more than 20% of household income for more than half of American families, according to Care.com.

Almost any payroll error could throw child care plans into a tailspin, so how would most people cope? For many Americans, child care is already an expensive service also demanding a great deal of scheduling and preparation. What happens when this difficult responsibility becomes even harder? Options exist, none ideal.

Relying on the kindness of friends or relatives, for example, is unlikely a long-term solution and can put undue stress on personal relationships. One or both parents can take time away from work to care for their kids, but once available PTO or sick days run out, their employment may be threatened. For those parents working positions without paid leave that are based on tips or hourly pay, the consequences of missing work can be even more sudden and detrimental.

For single parents whose income is the primary source for the household’s well-being, a lost job quickly creates a traumatic cycle for everyone involved.

3. Paying debt with debt

Employees rely on their paychecks for an obvious reason: They have bills to pay.

So when their paycheck arrives incomplete — or, worse, not at all — how do those bills get paid? For many Americans, the answers include credit cards, using a payday lender or borrowing money from friends or family.

According to Pew Charitable Trusts, 12 million Americans borrow a total of $9 billion in payday loans each year. 80% of those loans are taken within two weeks after repaying a previous payday loan.

These figures suggest that while payday loans provide a way to bridge the gap, their high annual percentage rates — at nearly 400%, per the Consumer Financial Protection Bureau — can create a dangerous financial cycle that’s difficult to escape. Overdraft fees can also compound the pain caused by payroll errors, especially when 43% of households reported paying these fees in 2021. And how many overdraft charges did they pay? On average — more than nine!

Stop the cycle before it starts

Addressing the root cause of payroll errors prior to payday is arguably the easiest solution. In most cases, it’s also the option carrying the lowest cost for both the employer and the employee. Nobody knows the specifics of an employee’s paycheck better than the employee, allowing them to quickly identify errors without having to contact someone in HR to fix something they could address themselves.

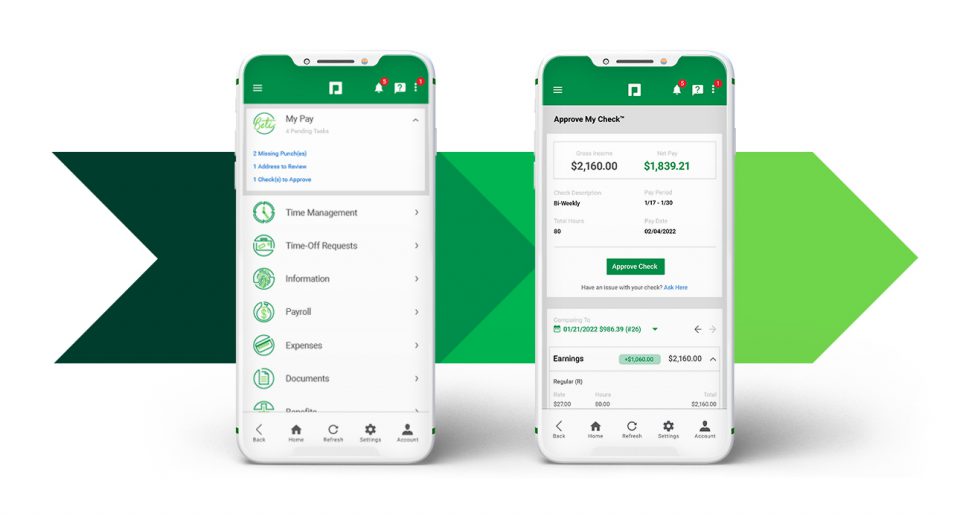

One way to get that accuracy is with the employee-driven payroll experience of Paycom’s Beti®. When employees can verify their own HR data — including hours, benefit deductions and expenses — and are guided by the software to identify and resolve errors before submission, the risk of costly, post-payroll errors is mitigated.

When errors are stopped before they start, nobody has to worry about the potential consequences. Learn more about how you will protect your employees from costly mistakes in their paychecks.

DISCLAIMER: The information provided herein does not constitute the provision of legal advice, tax advice, accounting services or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional legal, tax, accounting or other professional advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation and for your particular state(s) of operation.