On Dec. 17, a federal appeals court lifted the stay previously placed on the Occupational Safety and Health Administration’s (OSHA) emergency temporary standard (ETS) for COVID-19. This means OSHA can move forward with enforcement.

OSHA announced it will not issue citations for noncompliance with the ETS before Jan. 10. Additionally, OSHA stressed it would not penalize employers for failing to adhere to the standard’s testing requirement before Feb. 9, provided they have made reasonable, good faith efforts to comply.

While OSHA has indicated some flexibility with its ETS, businesses with at least 100 employees must:

- ensure employees are fully vaccinated or produce a negative COVID-19 test result every seven days

- provide employees with up to four hours of paid time off to get vaccinated and additional time off if needed to recover from the possible side effects of a vaccine

- maintain clear and accurate records of their compliance, including copies of their employees’ vaccine records and tests

- communicate the ETS policies across its organization while providing as much supplementary information as possible

Covered employers aren’t obligated to pay for their staff’s testing unless otherwise specified.

Get clued in

Concerned about complying with OSHA’s ETS?

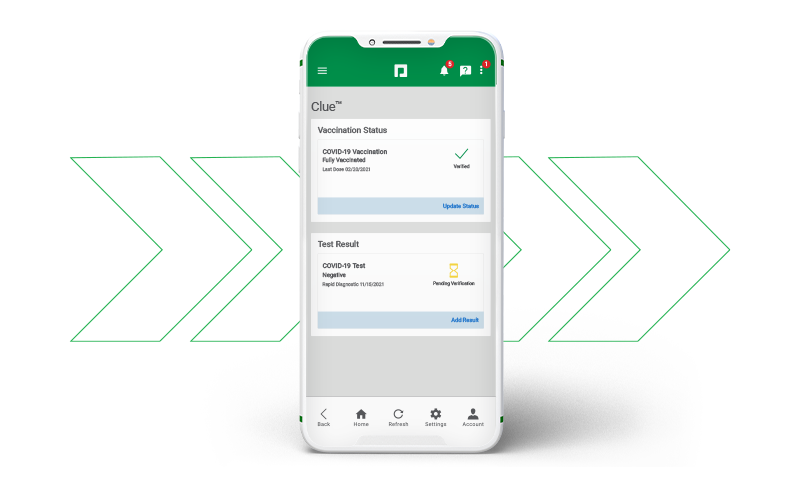

Clue™ makes it simple to get clued in to your workforce’s vaccination and testing status. By enabling you to easily collect, track and report your business’s COVID-19 data, Clue helps you confidently navigate this evolving compliance landscape.

Seamlessly integrated into our single software, this tool helps you achieve peace of mind by:

- empowering employees to quickly and easily provide their vaccination status or test results through our mobile app

- sending push notifications to remind employees of requested data and test due dates

- monitoring results and other statuses through an intuitive, action-based dashboard

- allowing you to confirm submissions and manage employees with positive test results

Plus, Clue lets you exclude remote workers who are unaffected by the ETS and readily add Form 3 exemption accommodations for religious or medical reasons. And the tool’s autogenerated reports give you the versatility you need to pin down the data most relevant to your enterprise.

Help protect your employees and ensure your compliance — get clued in today!

DISCLAIMER: The information provided herein does not constitute the provision of legal advice, tax advice, accounting services or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional legal, tax, accounting or other professional advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation and for your particular state(s) of operation.