GL Concierge

Easily and quickly send payroll data to your preferred accounting software

What it does

Simplify your general ledger process

We get it. Making sure payroll data accurately enters your accounting software is a thankless job. But it doesn’t have to waste your time, too. Our general ledger software frees you from manually keying data into your accounting program every pay period. GL Concierge generates perfectly mapped reports right in our single software — with just one login and password — for easy import.

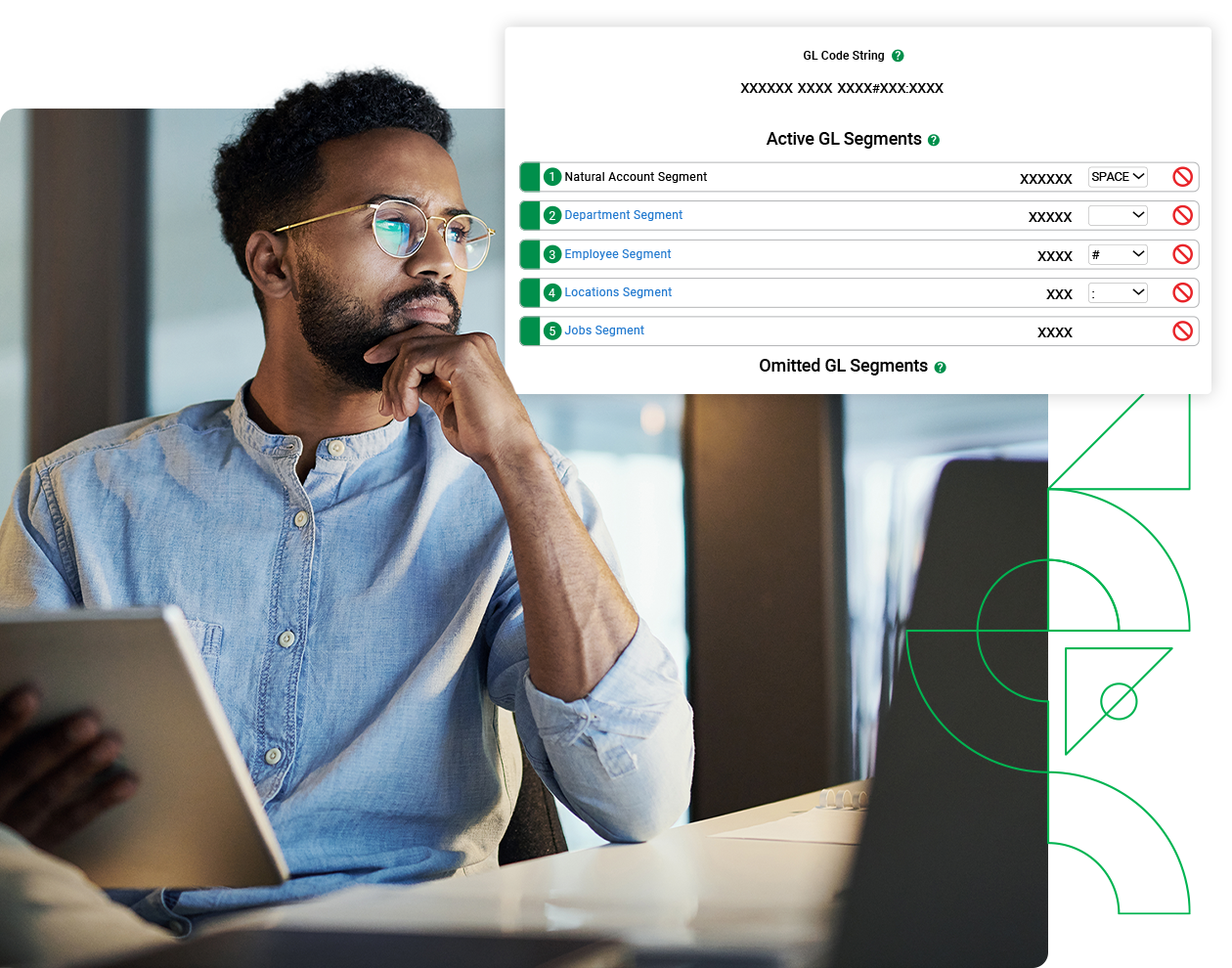

Infinite mapping

Our general ledger software makes it easy to organize payroll data in whichever way makes the most sense to you. This ensures your GL reports upload perfectly to your accounting tool of choice.

Get the credit you deserve

Your role’s too important to waste rekeying data. Since GL Concierge exists in Paycom’s truly single software, it automatically pulls deductions, new earnings, labor allocations and more for stress-free importing.

WHY IT HELPS

Drop mind-numbing tasks

Why rekey general ledger payroll data into your accounting software each pay period? Our general ledger software simplifies a complex and frustrating process, leaving you with space to breathe.

Goodbye, data errors

Since GL Concierge pulls data from our single software, you can stop rekeying data and correcting preventable mistakes.

Account management made easy

Does your business contain multiple entities? No problem! GL Concierge can combine reports across multiple EINs, so you don’t have to.

Transparent auditing

Whenever a change affects your general ledger entries, you're automatically alerted. Whether it impacts a code or file layout, you have full visibility into what change was made and who made it.

Mapped to perfection

Fed up with missing and incompatible info? On-demand access to data and the ability to export GL maps in any file layout ensure you have full control of your payroll ledger.

How it works

Make your ledger better

From an intuitive implementation to effortless functionality, you’ll wonder why anyone would manage their general ledger differently.

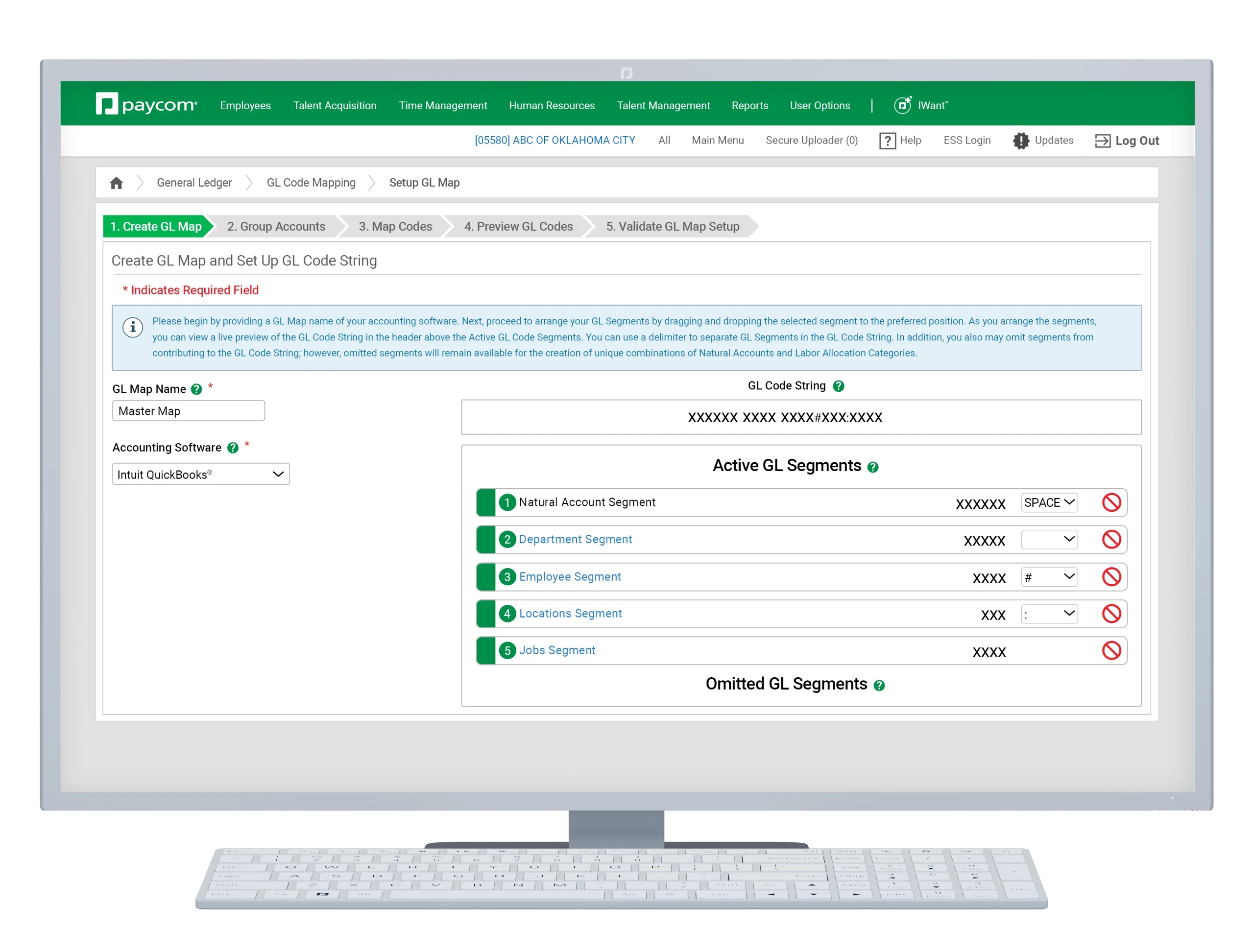

Simple setup

Don’t miss a beat with our streamlined layout and an easy, five-step guided setup. You can even preview and validate codes for flawless reports.

User-friendly

We've taken complexity out of the process. With our drag-and-drop functionality, creating multiple file layouts and grouping accounts couldn’t be easier.

Your data, your way

GL Concierge doesn’t reinvent the wheel — it just makes it easier to steer. You’ll enjoy a familiar, spreadsheet-style interface to organize your data the way you prefer.

FULL-SOLUTION AUTOMATION

GL Concierge seamlessly connects with

Beti®

Our self-service payroll experience prevents errors before submission. Then that spotless data flows seamlessly into GL Concierge for truly accurate reporting.

Our Labor Allocation tool automatically tracks your labor dollars and informs GL Concierge for an accurate process.

Tie GL codes to roles set within our Position Management tool, not people. This eliminates confusion to help ensure consistency among your general ledger entries.

Frequently Asked Questions

Learn more about general ledger software

A general ledger system is used to help employers track, retain and audit their finances. Often, companies divide their general ledgers by transaction type, which isn’t always in the form of cash on hand. For example, a general ledger could include the monetary value of specific product inventory, company vehicles or other important assets. Ultimately, a general ledger helps leaders understand their organization’s financial situation to make informed decisions.

General ledger software works by making it easy for businesses to track financial transactions and ensure accurate reporting. It can serve as a one-stop shop for all information related to a company’s transactions, while also helping it produce financial statements and identify blind spots, such as questionable or unknown transactions. And Paycom's GL Concierge allows you to easily export your payroll data into your preferred accounting software.

Ideally, general ledger software helps businesses track their financial history by offering a convenient view of their accounts. It can also automate certain data-driven tasks, so your account team isn’t saddled with time-consuming and error-prone reentry. This heightened accuracy can also give employers peace of mind in the face of an unexpected audit or even routine financial reporting.

Even for relatively small businesses, payroll can be complex and multifaceted. General ledger software helps accurately capture all payroll data — like for hourly, salaried and contracted employees — and helps ensure a smooth import into a company’s general ledger.

However, not all general ledger software is created equal. Certain options may still force HR and accounting to manually reconcile payroll data before it’s added to the general ledger. Paycom’s GL Concierge tool, on the other hand, exists in a truly single software. That means payroll data seamlessly flows into it, making it easier for you to export GL maps in your needed file layout safely and securely into your accounting software.

Yes, Paycom’s general ledger software offers easy-to-use, infinite mapping of data. This ensures a perfect import into your accounting software of choice, since you have complete control over how the data exports.

No. Because of Paycom’s truly single software, payroll data flows seamlessly into GL Concierge. All you have to do is map it the way you prefer.

Yes! GL Concierge's guided setup walks you through a simple, five-step process. No in-depth coding knowledge required.

Since GL Concierge exists in our single software, it’s protected by the same industry-leading standards as the rest of our HR tech. Paycom holds two of only 17 Tier IV certifications — the highest award given by the Uptime Institute — in the U.S.

Our general ledger software can produce reports related to any of your company’s financial information. Plus, our infinite mapping capability means any report can be fine-tuned to your business’s unique needs. For example, you can run reports containing:

- deductions

- new earnings

- labor allocations

- multiple EINs

- and more