Who We Help

See how Paycom transforms every workplace

Businesses of all sizes. Industries of all types. Employees in every role. Paycom’s single HR and payroll software is all you need to automate your processes and reach new heights of success.

COMPANY SIZE

Experience a new dimension in automation

Whether you employ dozens or thousands, our software helps maximize efficiency and ROI while scaling with you.

ROLE

Tech that puts you in position to win

Our software benefits employees at every level. See how we digitally transform the workplace in ways that matter to you.

INDUSTRY

Automated tech for every field

Our software transforms how businesses take care of business. See how we’re uniquely positioned to partner with yours.

COMPANY SIZE

Experience a new dimension in automation

Whether you employ dozens or thousands, our software helps maximize efficiency and ROI while scaling with you.

ROLE

Tech that puts you in position to win

Our software benefits employees at every level. See how we digitally transform the workplace in ways that matter to you.

INDUSTRY

Automated tech for every field

Our software transforms how businesses take care of business. See how we’re uniquely positioned to partner with yours.

5-star app ratings

Capterra

App store

Google play

What sets us apart

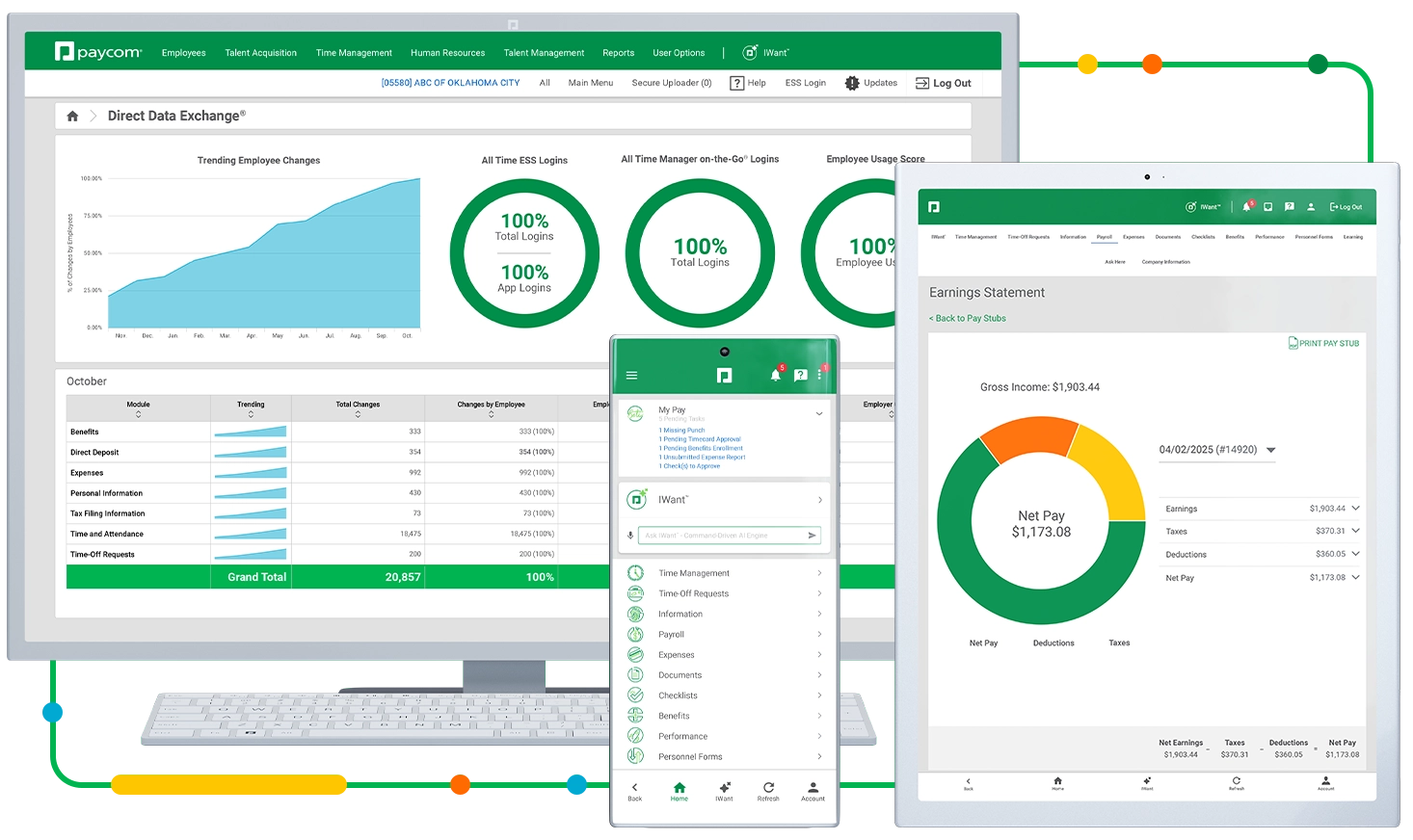

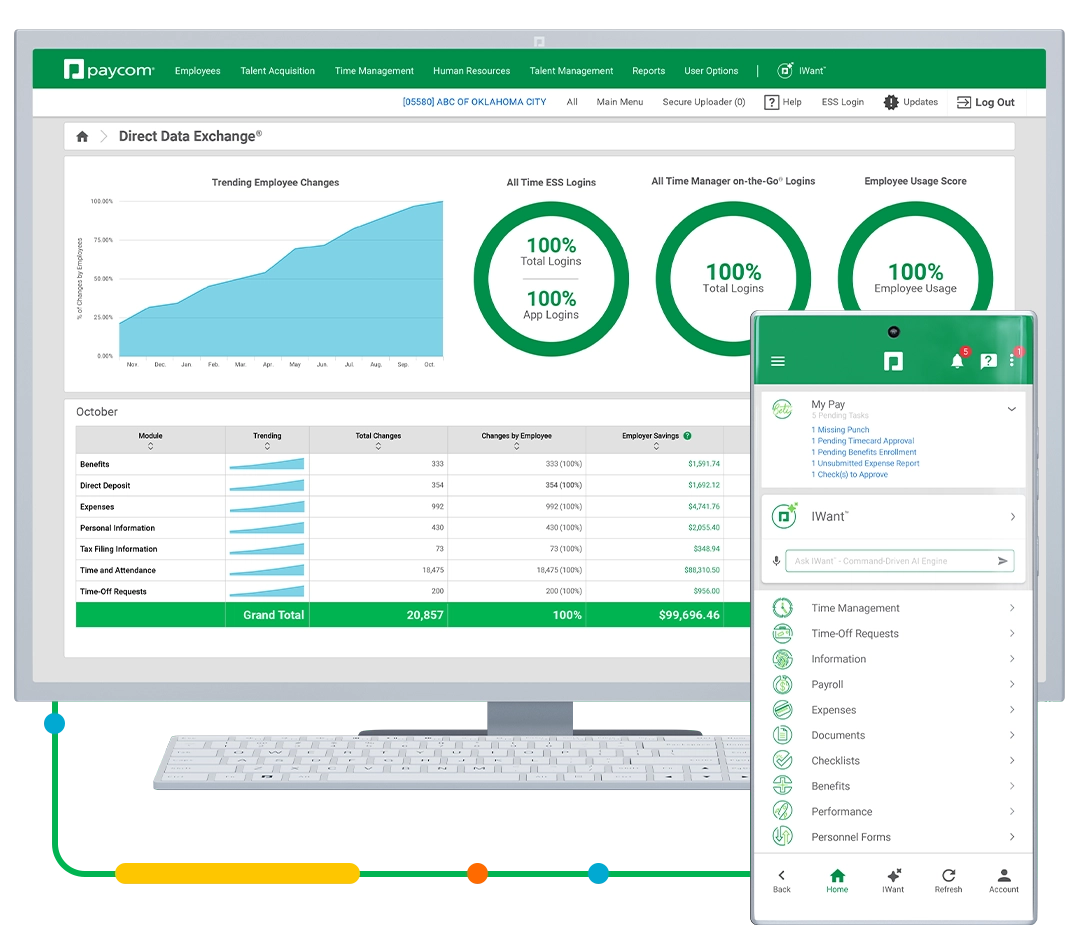

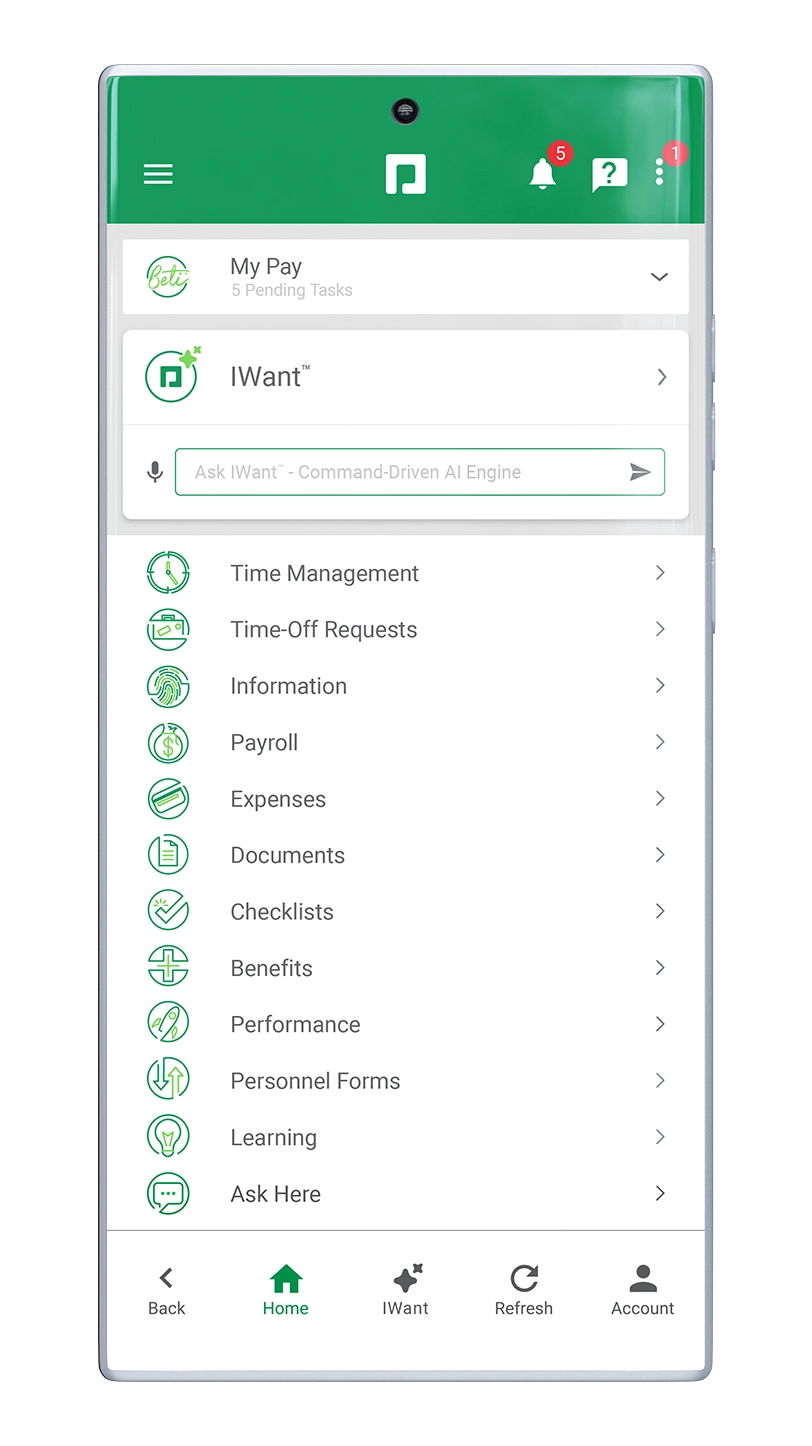

A single software for all your HR and payroll needs

One app with one login and password. That’s all employees need to access and manage their HR and payroll data. All our tools live in one software, so information flows seamlessly systemwide. This increases accuracy and eliminates duplicate tasks and data reentry. That’s the power of one.

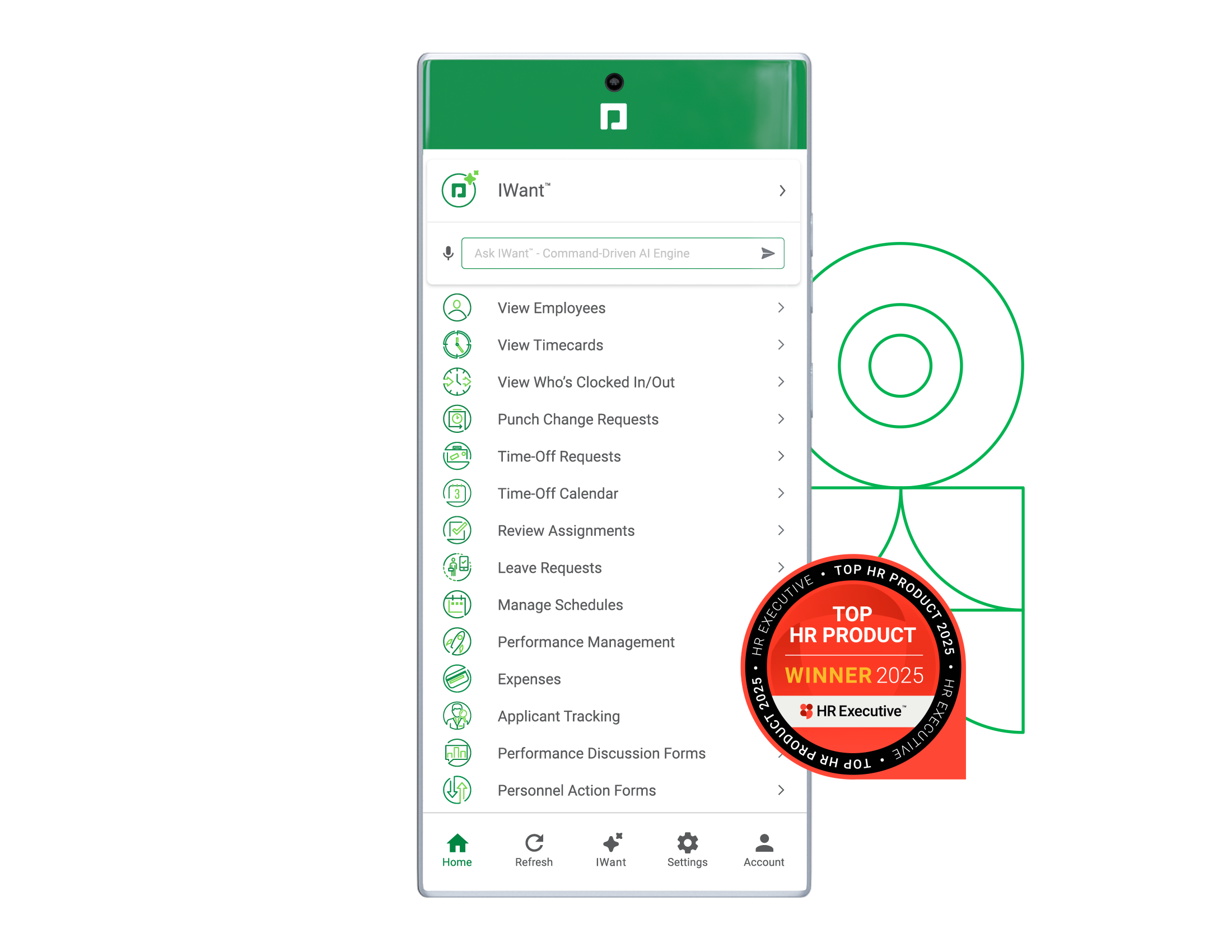

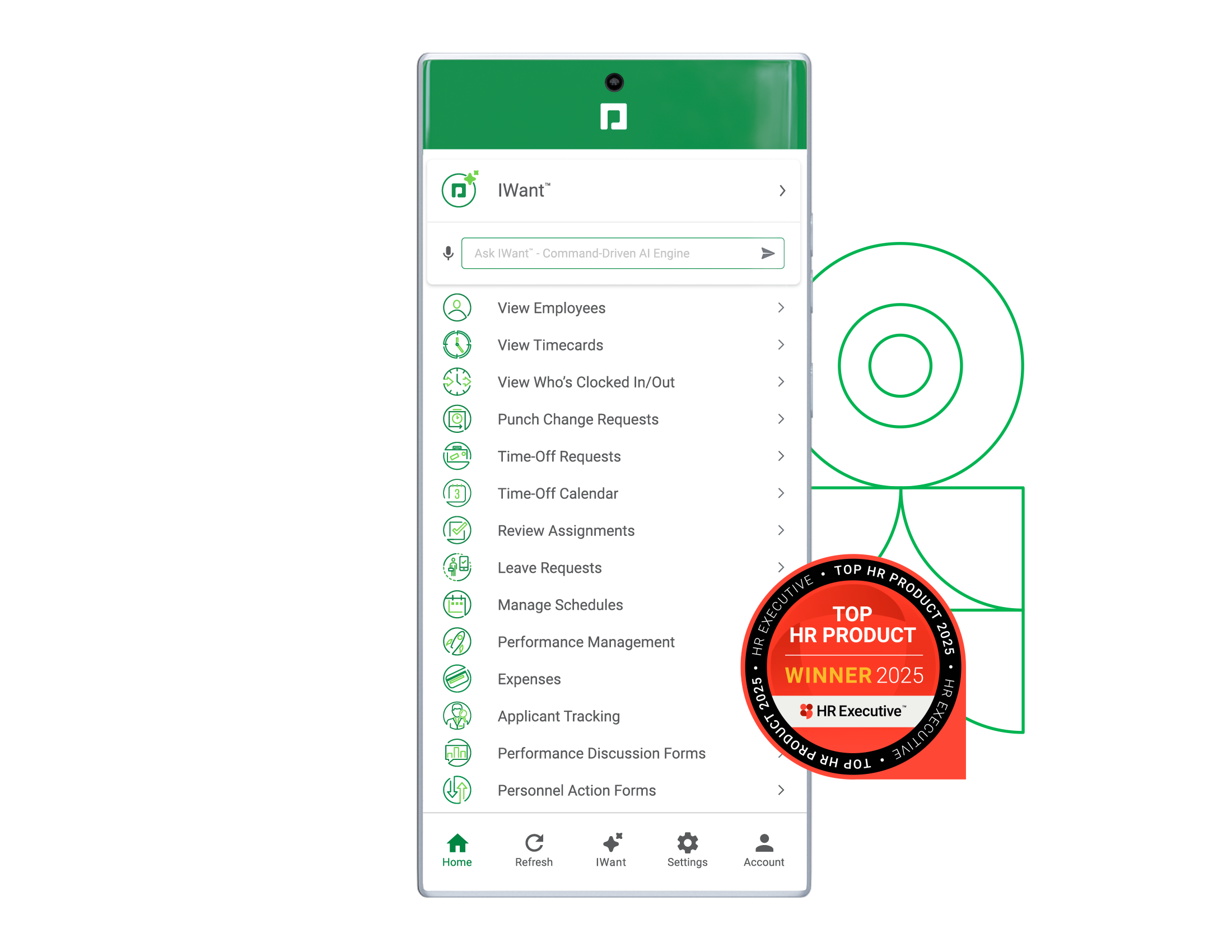

IWANT

The employee data you need — all at your command

We’ve revolutionized how users find and access employee data. Instead of hunting for the info you need, simply ask IWant™ — the industry’s first command-driven AI engine in a single database. It searches employee profiles and management dashboards to deliver instant, accurate answers.

How you benefit

Streamline your processes in a single software

Accurate payroll

Paycom’s HR tech automates payroll processing, finds errors and guides employees to fix them before submission. Come payday, expect more accuracy and less liability.

Simplified time and attendance

With software configurations to accommodate even the most complex systems and shift-specific criteria, managing time is smoother and more precise than ever.

Efficient recruiting

Easily find and secure ideal candidates with comprehensive applicant tracking, employment screening and onboarding tools that keep pace with your industry.

Unwavering security

Employee data must be protected with in-depth security measures. Our software is formally audited and ISO- and SOC-certified.

Higher retention

Paycom’s intuitive learning management software gives employees easy access to the development opportunities they want and the training they need.

Proactive compliance help

Put an end to time-consuming, costly noncompliance issues by helping prevent them from happening at all with self-service payroll.

Accurate payroll

Paycom’s HR tech automates payroll processing, finds errors and guides employees to fix them before submission. Come payday, expect more accuracy and less liability.

Unwavering security

Employee data must be protected with in-depth security measures. Our software is formally audited and ISO- and SOC-certified.

Simplified time and attendance

With software configurations to accommodate even the most complex systems and shift-specific criteria, managing time is smoother and more precise than ever.

Higher retention

Paycom’s intuitive learning management software gives employees easy access to the development opportunities they want and the training they need.

Efficient recruiting

Easily find and secure ideal candidates with comprehensive applicant tracking, employment screening and onboarding tools that keep pace with your industry.

Proactive compliance help

Put an end to time-consuming, costly noncompliance issues by helping prevent them from happening at all with employee-guided payroll.

Key statistics

The Total Economic Impact™ of Paycom

A commissioned Total Economic Impact study conducted by Forrester Consulting on behalf of Paycom, June 2023.

90%

less labor to process payroll*

2,600+

hours saved by HR annually*

80%

efficiency gains for HR and accounting processing payroll*

*Results are for a composite organization representative of interviewed customers.